Activation mode

- Upon creation or at the given start date. A subscription is activated by default when it’s assigned to a customer or account directly or via add-on unless a different start date is specified.

- Upon the account’s first usage. PortaBilling supports an additional mode of subscription activation based on the first use of the account. This helps you avoid issues when there is a delay between the time a customer signs up for a service and the time they start using it (for example, the customer signs up for Basic residential VOIP service, but their IP phone is delivered by FedEx only five calendar days later).

Charging method

At the end of the billing period

This method is commonly used for reliable customers like corporate clients and small to medium businesses where payment issues are not anticipated.

When subscriptions are billed at the end of the billing period, it is easy to modify services in the course of the billing period. No refunds are required. For example, a customer activates and later deactivates a subscription to a service in the middle of the billing period; when the customer’s billing period ends, PortaBilling calculates the applicable charges only for those days when the subscription was active.

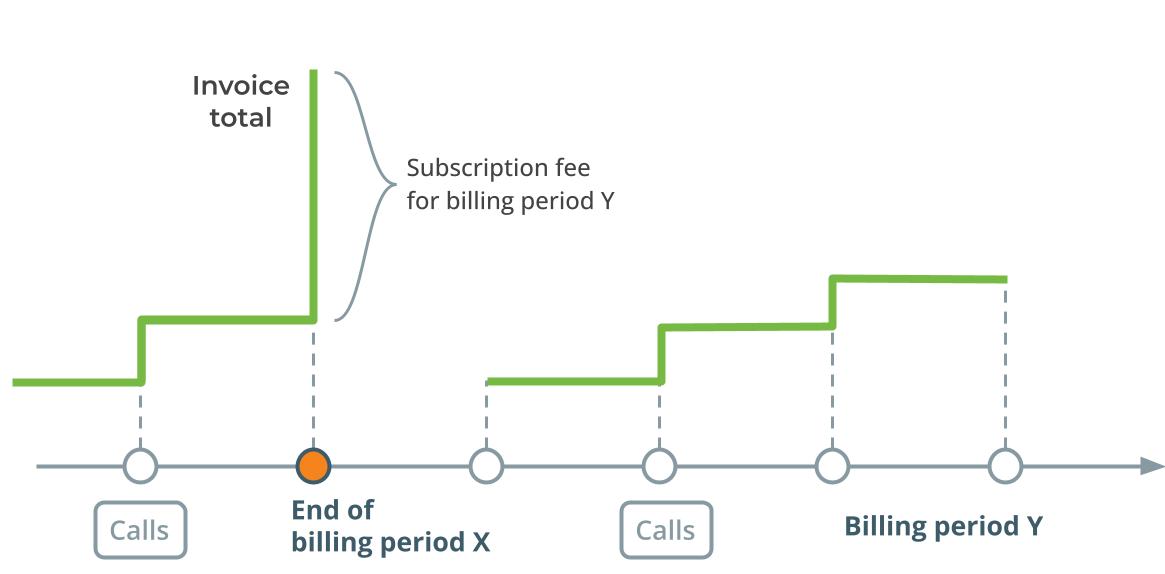

In advance

This charging method allows you to charge customers for subscriptions at the beginning of the billing period. For instance, charges for July are generated on July 1st.

The “In advance” charging method for subscriptions is most suitable for retail customers.

It takes PortaBilling admins a significant amount of time to resolve individual payment with late payers if such issues arise. This reduces the amount of uncollected debt from customers who were terminated due to non-payment. The initial subscription charge is applied upon subscription activation, and charges for the subsequent billing periods are calculated and applied at the end of each preceding billing period.

Your postpaid customer John with a monthly billing period is subscribed to a $9.99 per month “Retail package” that includes 500 minutes of calls to the EU. “Retail package” is a subscription charged in advance.

A regular invoice for $9.99 with the subscription fee for April is issued on April 1st and the invoice becomes overdue on April 7th.

On April 14, 7 days after the due date, there is still no payment from the customer and the service becomes suspended (as defined in our Invoicing configuration in Customer Class). The admin tries to communicate with John, but he doesn’t respond or pay the invoice.

If John already used up the 500 minutes included in the subscription, the service provider’s maximum potential loss is $9.99.

Now let’s suppose John was a postpaid customer with the same Invoicing configuration in Customer Class.

On April 1st, a regular invoice for $9.99 with the subscription fee for March is issued. On April 7th, the invoice becomes overdue and on April 14th, the service is suspended. By April 14th, John used the 500-minute limit for both March and April.

In this scenario, the service provider would suffer a maximum loss of $19.98, which is twice as much as when the In advance charging method is used.

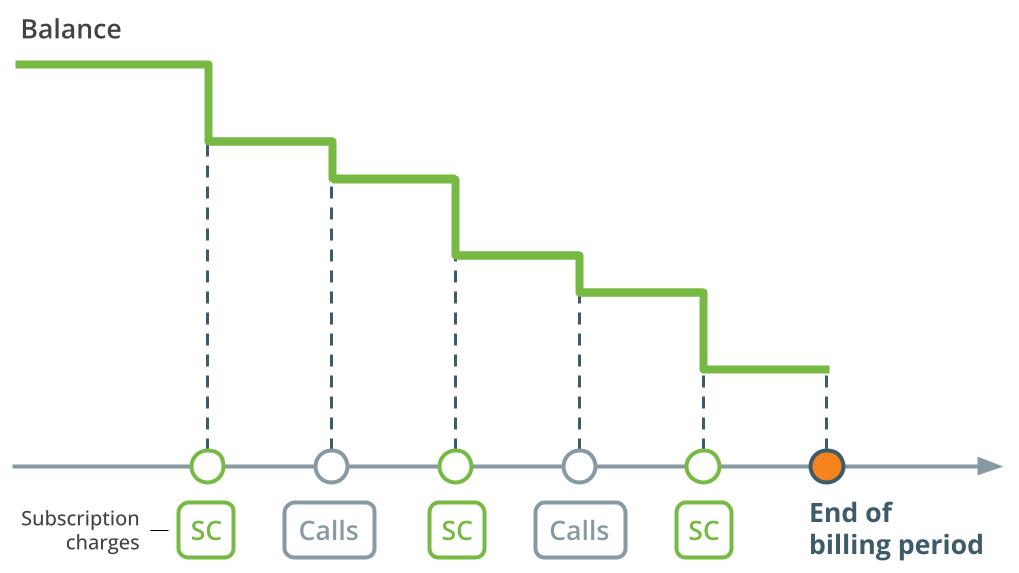

Progressively

This charging method is only used together with the prepaid business model for cost-sensitive markets. Its purpose is to prevent significant charges at the start of the billing period, which can lead to other services, such as pay-as-you-go calls to destinations not included in the subscription, becoming unavailable due to insufficient funds.

Charges are applied progressively every day of the billing period, e.g., 1/30 of the total amount for the monthly billing period.

If a customer signs up for a monthly billing period and chooses a subscription for “US and Latin America” priced at $30/month starting from April 1st, the customer will be charged $30/30 =$1 per day throughout the billing period. At the end of the billing period, the total charged amount will be $30, which is the monthly recurring fee.

Essentially, the customer is charged small amounts every day, allowing their balance to decrease slowly and giving them ample time to take action and add more funds to their balance.