Temporary credit limits

You can empower employees to define a temporary credit limit for a customer depending on the confidence level that you share with your employees. You can:

- Adjust a temporary credit limit for each PortaBilling user depending on the trust level you share with them.

- Assign a temporary credit limit amount.

- Set an amount either as an absolute value or as a percentage of the original credit limit.

- Assign a period for temporary credit limit usage.

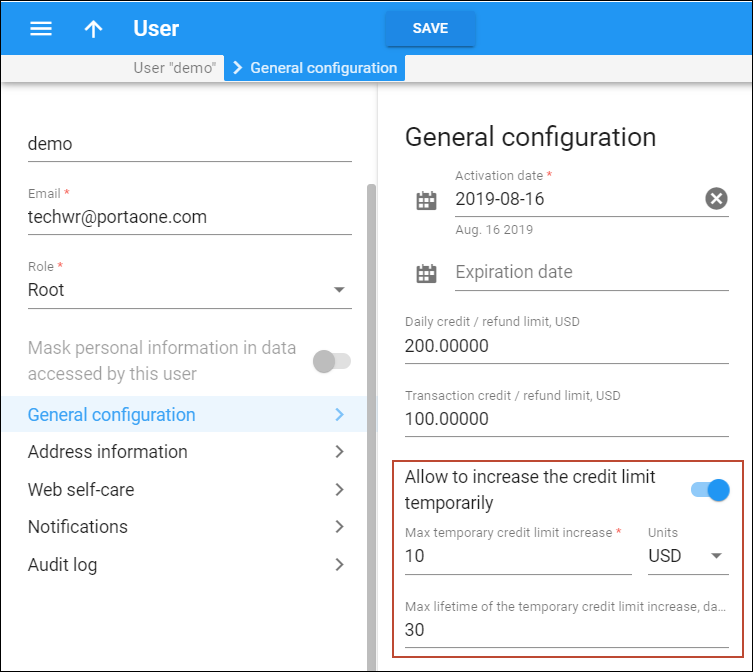

To do this, enable the Allow to increase the credit limit temporarily option on the General configuration panel of the administrative user. Specify:

- The maximum amount of the temporary credit limit and

- The duration for this temporary credit usage.

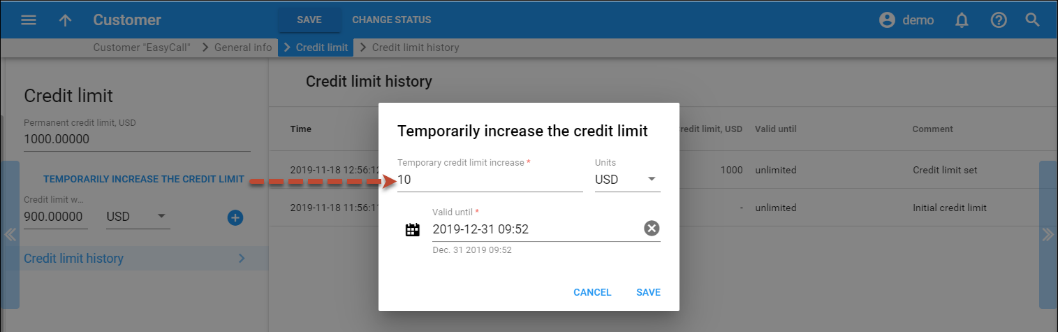

Your staff can increase the credit limit for a particular customer, distributor and reseller on the Credit limit panel. The amount and duration of this temporary credit limit cannot be higher than allowed for this user.

Consider the following example: A business owner sets a credit limit increase for a Helpdesk operator named Roger as follows:

- Temporary credit limit amount – 10% of the original credit limit;

- Duration – 30 days.

For the customer relations manager (CRM), Andrew, he defines different values:

- Temporary credit limit amount – 20% of the original credit limit;

- Duration – 60 days.

Customer John Doe has a $200 original credit limit. He has reached the limit and he has made a payment, however, the money has not yet transferred to his PortaBilling account. John urgently needs to make some calls so he attempts to obtain a temporary credit limit increase. He calls the ITSP Helpdesk and asks to recharge his account by $20 for the next 7 days. The helpdesk operator satisfies this request since both parameters (amount and duration) do not exceed the maximum values allowed for the helpdesk staff.

The customer EasyCall Ltd. has a $1000 original credit limit. The company also faces a situation when their original credit limit is reached. The representative of the company makes a call to the ITSP Helpdesk and requests a credit limit increase of $200 for 40 days. The helpdesk operator does not have permission to raise the limit (neither the amount nor the duration are allowable), so he raises the issue to the CRM. The CRM knows that EasyCall Ltd. is a reliable customer that can be trusted, so he increases the credit limit and the duration period. The customer EasyCall Ltd. is satisfied and continues to enjoy the services.

Consequently, it is now possible to define different temporary credit values for CRMs, helpdesk operators and other employees, individually. A business owner can easily define and change these values on the PortaBilling web interface; default values are set on the Configuration server.

Daily and transaction limits on credit/refund for PortaBilling users

To prevent potential abuse by employees and avoid money leaks, you can define daily and transaction limits on credits/refunds for PortaBilling users.

On the General configuration panel, you configure the following:

- Daily credit/refund limit – this defines the amount the user cannot exceed for generating either a credit or a refund for customers during a 24-hour period.

- Transaction credit/refund limit – this defines the amount the user cannot exceed per transaction.

- Max temporary credit limit increase – this defines the maximum amount by which the user can increase the temporary credit limit (either as an absolute value or as a percentage of the permanent credit limit), and the credit usage’s valid time.

Limit values change after each transaction that impacts the limit: manual credit, promotional credit, refund, and e-commerce refund. The limits are reset at midnight (in the time zone of the PortaBilling user’s environment).

Let’s consider the following example. The business owner defines a daily limit of $200 and a transaction limit of $10 to helpdesk operator Pete.

- Pete attempts to apply a $15 credit to a customer but the operation fails.

- Pete applies a $3 credit to a customer and the operation is successful, so Pete’s daily credit/refund usage is now $3.

- Pete applies a $2 refund to a customer and the operation is successful, so Pete’s daily credit/refund usage is now $5.

- Pete applies a $20 manual payment to a customer and the operation is successful, so Pete’s daily credit/refund usage does not change (it is still $5).

- Pete applies a $20 credit card charge to a customer and the operation is successful, so Pete’s daily credit/refund usage again does not change (it is still $5).

- Pete subsequently applies a $10 credit to 19 different customers and all of the operations are successful, so Pete’s daily credit/refund usage is now $195.

- Pete attempts to apply a $10 credit to a customer but the operation fails since Pete’s daily limit is exceeded.

- After midnight, Pete’s daily credit/refund usage is again reset to its defined values and he can retry the transactions.

Thus, you protect your business via money allocation control in the credit arena.