The Subscriptions module allows you to charge periodic fees to your customers for using the service. If your advertisement states something like “only $9.99 per month, and just $0.99 extra per month for Voicemail service,” then two subscription plans are involved. The parameters you specify within a subscription plan affect the customer balance. Each subscription plan includes the following:

- Name and description – Your administrators use this to better manage various subscription plans.

- Subscription plan name visible to end user – This is a clear subscription name that is shown to end users on invoices and on their self-care interfaces.

- Activation mode – This specifies when a subscription is active and when charges start. A subscription is typically activated upon its creation (or on the start date, if that is specified). PortaBilling supports an additional mode of subscription activation based on the account’s first use. You can avoid issues when there is a delay between the time a customer signs up for a service and the time they can actually use it (e.g., the customer uses online signup to purchase a residential SIP service, but their IP phone is not delivered by FedEx until five days later).

- Minimum subscription period and early cancellation penalty – It is common practice to lock a customer’s contract for a certain period (e.g., if you provide the customer with a free IP phone, you want to make sure they continue paying monthly fees until the cost of the phone is paid back). If the subscription service is canceled earlier than the interval specified, the customer is charged a cancellation penalty.

- Subscription fees – These are the charges applied while the customer has an active subscription; see below for more details.

Subscription fees

When a customer’s billing period closes, PortaBilling calculates the charges for any subscriptions that were active during this period. For each subscription, there are three types of charges:

- Activation fee

- Cancellation fee

- Periodic fee

Activation fee

An activation fee automatically applies when a subscription start time begins, with one exception. Namely, in the subscription plan’s properties you may specify that the subscription plan will be active only when the account is used for the first time. In this case, the subscription is activated either on its start date or on the date of the account’s first use, whichever comes later.

Cancellation fee

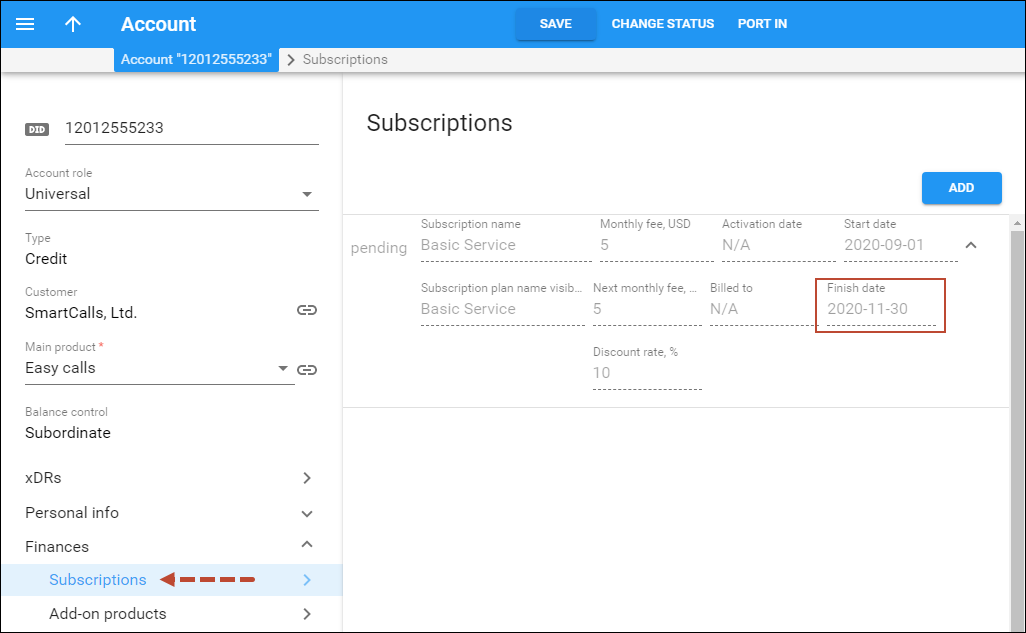

A subscription which is not yet active can simply be deleted (for instance, a customer signs up for a new service beginning next month, but then changes his mind). A subscription that is already active cannot be deleted (see the Applying subscriptions section for details). When a subscription is canceled, the cancellation date is entered as the finish date for the subscription and the customer is charged a cancellation penalty.

The cancellation date is typically the day on which cancellation takes place. However, you can also schedule a cancellation for a future date (e.g., a customer wishes to use the service until the end of the present month).

The record of the canceled subscription allows PortaBilling to correctly charge for closed subscriptions. For example, if a customer subscribes to the service on the 3rd and cancels it on the 7th, he is still charged for five days of service.

You can define the cancellation penalty as either a fixed amount or the remaining subscription charge. In the latter case, if the customer’s $5 subscription must be active for 10 months but they cancel it in six months, the customer’s cancellation penalty is $20, which is the sum of charges for the remaining four months.

Note that if you change the subscription fee (e.g., from $5 to $7) before a customer cancels their subscription, PortaBilling uses the new fee to charge the cancellation penalty. Thus, a customer from the example above is charged $28 ($7 * 4 months) as a cancellation penalty.

Periodic fee

A periodic fee defines the recurring charges applied to a customer for service usage.

When a customer signs up for or cancels a subscription in the middle of a billing period, you can charge them either the prorated or full periodic fee. Thus, if a customer with a monthly billing period signs up for the subscription on March 17th, the charge can be either for 15 days in March (17th-31st) when the subscription is active or for the full month.

The following examples relate to the same subscription plan with a monthly periodic fee of $9.99, and illustrate how it is prorated:

- Customer A, with a monthly billing period, activates the subscription on April 12th. On May 1st, the customer is charged $6.33 because they used the service for 19 days (April 12-30th) and 19 * ($9.99/30) = $6.33.

- Customer B, also with a monthly billing period, activates the subscription on April 12th but cancels it on the 25th. On May 1st, the customer is charged $4.66 because they only used the service for 14 days (April 12-25th) and 14 * ($9.99/30) = $4.66.

These types of subscription fees are reflected on the invoice as extra invoice lines.

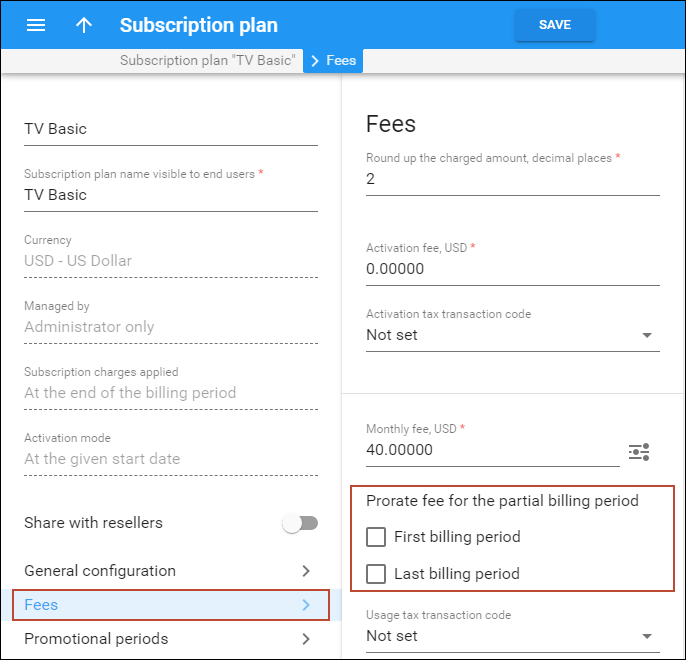

By default, the first and last partial billing periods are charged with a prorated fee. To charge for subscriptions in full, go to Subscription plans > Fees > Prorate fee for the partial billing period option > and clear the check boxes for the first/last billing period.

Note that this option is available if you charge for subscriptions At the end of the billing period or In advance and is not available for Progressive (daily) subscriptions.

Also, if you set up the non-prorated (full) fee, still there may be credits issued for the days when a customer cannot use the service due to service suspension, block, having exceeded credit limit, etc. (credits are issued according to the Issue credits for the days when and Skip credits, charge in full options configuration).

The ability to set up the non-prorated (full) fee enables you to adjust subscriptions to your business requirements. For instance, you may want to balance the cost and revenue while you resell your partner’s services on a recurring fee basis.

Let’s consider an example company ABC, which offers IPTV services to end users for a monthly subscription fee. The IPTV vendor charges ABC in full even if their customer cancels the subscription. To avoid revenue leakage, the ABC company can also charge the customer in full for the last month of service usage.

Thus, when charging full fee for partial billing periods, you can ensure that the subscription charges cover the cost, no matter when the subscription is activated/canceled.

You can also modify the periodic fee for a subscription plan once it has been activated (e.g., you can decide to increase/decrease the price for a service).

If the charge for subscriptions is applied at the end of the billing period, the fee changes are applied immediately to the current billing period. All the charges for the following billing period will use the updated periodic fees.

If the charge for subscriptions is applied in advance, the fee changes have no influence on the billing periods that have already been charged for but are applied to each subsequent billing period. In other words, there is no recalculation. The charges for the next billing period use the updated periodic fees.

For example, if a subscription fee of $10 is charged one month in advance and the current monthly billing period ends on April 10th, the customer is charged until May 10th.

On April 25th, the subscription fee changes to $8. The customer’s invoice (produced on April 11th) contains the charges for all calls made before April 10th and the subscription charges covering the period from April 11th to May 10th without recalculations (i.e., the subscription charges are still $10 for this billing period despite any changes).

The new subscription fee ($8) is applied to the new billing period, which covers the period from May 11th to June 10th, and the customer continues to be charged $8 for each subsequent billing period.

Rounding

You can choose what rounding method to apply to the charged amount for subscriptions in the customer class.

You can select one of the following rounding methods:

- Away from zero – this rounding method is selected by default. It works similar to rounding up but differs when rounding negative values. Positive and negative values round symmetrically. For example, if the rounding precision is set

to two decimals, then:

- 1.214, 1.215 and 1.216 all round up to 1.22.

- – 1.214, – 1.215 and – 1.216 all round to – 1.22.

- Half away from zero – this rounding method works similar to arithmetic rounding but differs when rounding negative values. Positive and negative values round symmetrically. For example, if the rounding precision is set to two decimals,

then:

- 1.214 rounds to 1.21, 1.215 and 1.216 all round to 1.22.

- – 1.214 rounds to – 1.21, – 1.215 and – 1.216 all round to – 1.22.

- Special rounding (malaysian) – formerly known as custom rounding. This type of rounding depends on the last decimal at precision point. For example, if the rounding precision is set to two decimals, then:

- If the last decimal at precision point is [0…2], it is set to zero. For example, 1.204, 1.215 and 1.226 all round to 1.20.

- If the last decimal at precision point is [3…7], it is set to 5. For example, 1.234, 1.255 and 1.276 all round to 1.25.

- If the last decimal at precision point is [8…9], it is set to 0 and the previous decimal increases by 1. For example, 1.284, 1.296 all round to 1.30.

Also, you can choose the number of decimals to round the charged amount for a specific subscription plan in the Rounding precision option on the Fees panel.

Periodic fees configuration

Since your customers may have different billing periods, PortaBilling provides you with the flexibility to individually assign subscription costs for each period. For instance, if your monthly rate is $19.99, you may want to charge a higher weekly rate than $4.99, since the maintenance required by customers with shorter billing periods increases, and justifies a higher rate.

For instance, PortaBilling allows you to define your monthly rate as $19.99, your semimonthly rate as $10.99, your weekly rate as $6.99 and daily rate as $1.99 for the exact same subscription plan. PortaBilling will automatically use the correct base value according to the customer’s billing period.

Promotional periods

Yet another common business practice is to offer special rates for an initial period following signup (e.g., “Only $9.99/month!”) while the disclaimer states: “For the first six months only, after which the standard rate of $29.99/month applies.” PortaBilling allows you to define an unlimited number of promotional periods, with different subscription fees for each. For example, you could create a subscription that offers free service for the first three months, a rate of $9.99 for the next nine months, and $12.99 thereafter; or something even more complex.

Incompletely used promotional periods

A subscription’s promotional period includes each billing period during which a service is used, regardless of how many days the service is used in a particular billing period.

For example, let’s say you offer a promotional period for three months and your customer John Doe subscribes to it on July 15th. John Doe is charged for the second half of July (16 days) and for the following two months (August and September) according to the promotional rate. Starting from the fourth month (October), the default rate is used.

In order to avoid potential misunderstandings when a customer expects a longer promotional period (till October 15th from the example above), the best practice is to use an anniversary billing cycle, as this eliminates the problem of “incompletely used” promotional periods.

Applying subscriptions

Since a product defines the way you provide a service to an end user, and subscriptions define charges for this service, it is obvious that they must be interconnected. That’s why subscriptions are usually included with products (they can be selected from the subscription list.) To define a flat rate for provided service(s) and avoid discrepancies between subscription plans with different configuration parameters, only one subscription plan per product (both main and add-on ones) is allowed.

Subscriptions that an account receives with the products requested are called obligatory subscriptions, because it is not possible to remove or cancel these subscriptions as long as the account uses these products. You may, however, add optional subscriptions to an account (e.g., if an EasyCall product user wishes to receive Voicemail service). These optional subscriptions can be added or canceled as you wish. Note that you can only apply the same subscription once to an account if it has not been explicitly defined in its configuration (see the Multiple subscriptions section for details).

You can also assign subscriptions to a specific customer. Here the procedure is exactly the same as with an account. Since a customer cannot have a product assigned directly to him, there are no obligatory subscriptions, in this case, i.e., all of a customer’s subscriptions are optional.

Add-on product subscriptions

Both a feature and a subscription are attached to add-on products, so an administrator must only assign an add-on product to an account. Once the feature is activated, the customer is automatically charged for it.

For example, a customer is assigned the “Call Waiting” add-on product with the call waiting feature enabled and a subscription associated with it that applies recurring charges for its usage. If the customer no longer needs call waiting functionality, the administrator removes the add-on product from the account properties with a single mouse click.

Multiple subscriptions

In most cases, every single subscription is charged only once even if this subscription is included in with several add-on products assigned to the account.

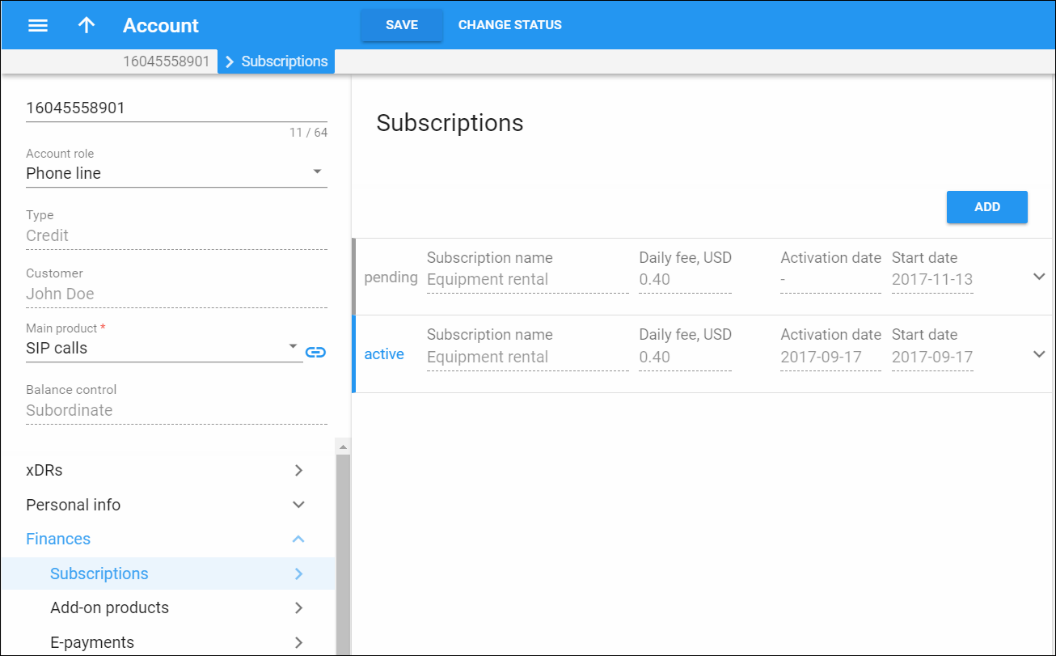

But in some cases, it is necessary to assign the same subscription multiple times.

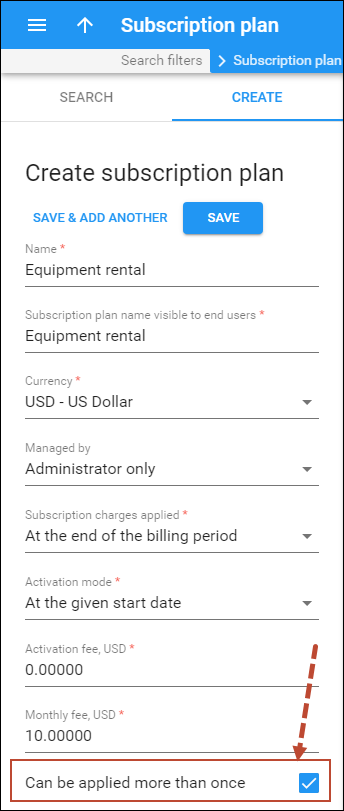

Let’s have a look at the following example. One of your customers is assigned a subscription for renting a router from you. On another day, they want to rent a second router and must therefore be charged the same subscription twice: for the (first) already rented router and for the newly rented one. Since this customer’s account already has a subscription for renting a router, a new add-on product is created with the same subscription assigned for the rent of the second router.

To make this happen, the administrator enables the Can be applied more than once option within the subscription plan configuration. This makes it possible to assign the same subscription to one account multiple times.

This model of applying subscriptions makes it possible to:

- provide revenue assurance, because using an add-on product guarantees that the feature will be activated, and the customer automatically charged for it; and

- save time, because everything can be done in one place using an add-on product.

Changing the subscription plan for a product

You may change the subscription plan for a given product at any time. This, however, affects all existing accounts that have this product. Once you select a new subscription plan for a product, the change takes immediate effect: the old subscription plan is removed and the new one is applied to all accounts with this product assigned.

Changing an account’s product and subscriptions

A change of product for an existing account, e.g., from product A to B, will have the following effect on this account’s subscriptions:

- The obligatory subscription plan (inherited by the account from product A) changes to the subscription plan assigned to product B.

- Optional subscriptions (assigned to the account directly) remain unchanged.

Ways to charge for subscriptions

Traditional method

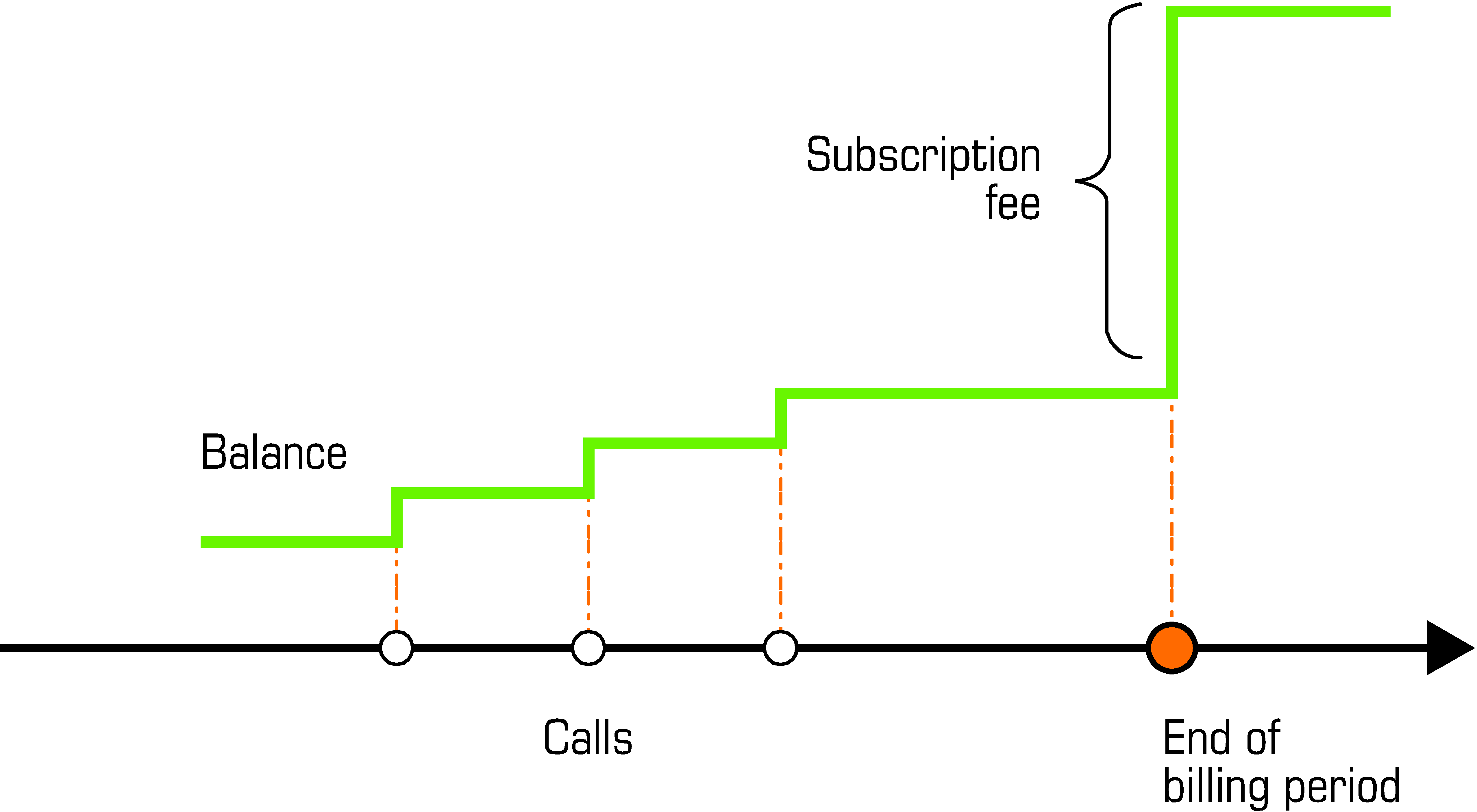

This is a very common and widely popular method. When a customer’s billing period closes, PortaBilling calculates the applicable charges for all subscriptions that were active during that period and applies them to the customer’s balance.

Consequently, once the billing period is closed there may be a significant increase in the customer’s balance.

Progressive method

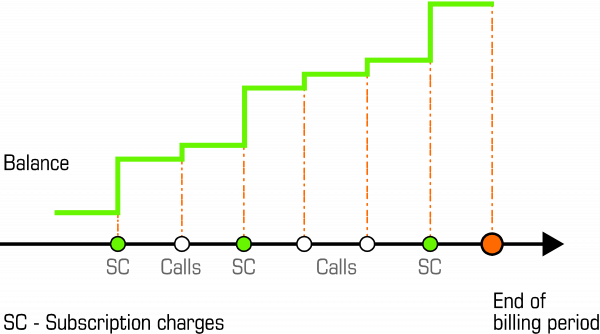

While the situation described above is acceptable for postpaid customers with a large credit limit, or if a customer has a credit card that is automatically charged when a billing period is closed, it may create certain problems for prepaid customers. If such a customer does not have sufficient available funds at the end of the billing period, his balance will exceed the credit limit and his outgoing calls may be blocked. PortaBilling provides a solution to this problem by allowing you to conveniently offer prepaid VoIP services in combination with subscription fees.

To avoid the unpleasant situation of a sizeable charge at the end of the billing period, PortaBilling’s progressive charges are continuously applied. This means that at any given moment in time, the charged amount will cover the interval from the beginning of the billing period until the current day. For example, a customer with a monthly billing period signs up for a subscription with a $9.99 monthly fee on April 1st. This means that every day of the billing period the customer is charged $9.99/30 = $0.33. By the end of the billing period, the total charged amount is equal to $9.99. In effect, the customer is charged small portions of the full fee every day. His balance grows slowly, giving him enough time to act in response and deposit more money into his account.

Subscriptions charged in advance

This mode of charging allows service providers to charge customers for one or more billing periods in the future. PortaBilling applies ‘in advance’ charges for the following period at the end of the current billing period.

Let’s say that your postpaid customer John Doe wants to rent an IP phone from you. You want John to pay for the phone rental in advance so you assign a subscription plan that is $30 with a $10 activation fee, charged one month in advance.

Once a subscription plan is activated, PortaBilling immediately applies the subscription charges for the current billing period. At the end of the billing period, PortaBilling applies the following month’s charges in advance and adds them to the customer’s invoice.

So if you assign a subscription plan to John on April 1st, PortaBilling immediately applies both the $10 activation fee and the $30 periodic fee to John’s balance.

At the end of April, PortaBilling calculates all of John’s usage charges for the current billing period (April) and applies the following month’s subscription charges in advance (May). Thus, on May 1st John receives his invoice and sees charges for calls made in April plus the subscription charge for $70 that covers:

- the $10 activation fee;

- the $30 periodic fee from April 1st to April 30th; and

- the $30 periodic fee from May 1st to May 31st.

On June 1st John receives his invoice and sees charges for calls made in May plus the $30 subscription charge that covers from June 1st to June 30th.

An ‘in advance’ subscription plan can be activated at any time (e.g., on April 10th). In this case, by default, the subscription fee is prorated so that the customer is charged for the actual service usage (i.e., 20 days covering the period from April 10th to April 30th).

Note that by default, when a customer signs up for or cancels a subscription in the middle of a billing period, they are charged the prorated periodic fee. You can charge customers a full fee. See the Periodic fee chapter for more details.

Let’s say that John signs up for the service on April 10th. As described above, as soon as the subscription is activated, PortaBilling applies the $10 activation fee and the $20 periodic fee (i.e., a daily fee [$30 monthly fee/30 days] * 20 days’ usage) to John’s balance.

At the end of April, PortaBilling applies an ‘in advance’ subscription charge for May. Thus, on May 1st John receives his invoice with charges for calls made in April plus the $60 subscription charge that covers:

- the $10 activation fee;

- the $20 periodic fee from April 10th to April 30th; and

- the $30 periodic fee from May 1st to May 31st.

You can charge your customers several billing periods in advance. In this case, PortaBilling applies the full ‘in advance’ charge in the first billing period and then updates the subscription charges later on.

Have a closer look at this case. Let’s say that you charge your customers 3 months in advance for their IP phone rental. Once Mark Roe signs up for the service on April 20th his subscription plan is activated. The $20 charge is applied to Marks’s balance ($10 activation fee plus a $10 periodic fee) for the period from April 20th to April 30th.

At the end of April, PortaBilling calculates Mark’s charges and applies the subscription charge for 3 months in advance. Therefore, on May 1st Mark receives his invoice and sees charges for calls made in April plus the subscription charge of $110 that covers:

- the $10 activation fee;

- the $10 periodic fee from April 20th to April 30th;

- the $30 periodic fee from May 1st to May 31st;

- the $30 periodic fee from June 1st to June 30th; and

- the $30 periodic fee from July 1st to July 31st.

At the end of May, PortaBilling detects that Mark’s subscription charges cover only 2 months out of 3, since May is already paid for. Therefore, PortaBilling applies a one-month subscription charge ($30) which brings the total subscription charge to 3 months in advance once more.

On June 1st Mark receives his invoice and sees charges for calls made in May plus a subscription charge for $30 that covers his IP phone rental for the period from August 1st to August 31st.

Subscriptions charged in advance to prepaid customers

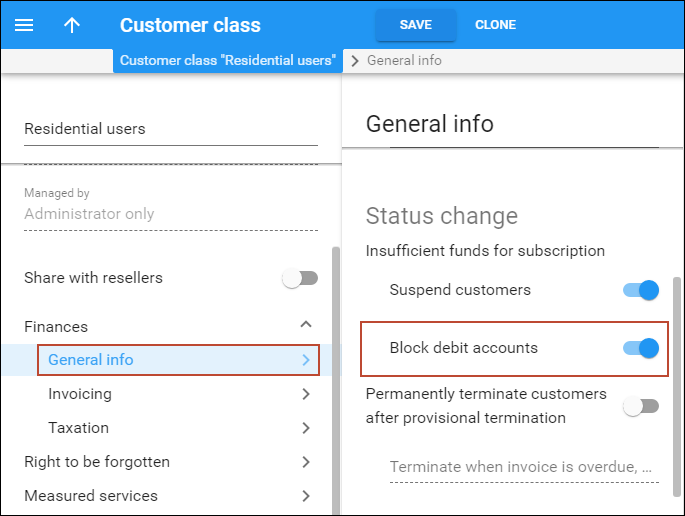

In most cases, subscriptions charged in advance are assigned to prepaid customers. Therefore, an administrator must be sure that customers have sufficient funds to cover their subscriptions. When they don’t, the customers’ service is suspended.

The subscription plan configuration includes an option for automatically suspending prepaid customers’ service when their funds are not sufficient to cover pending subscription charges.

This is how it works:

- Customers who have sufficient available funds have their subscription charges applied normally.

- Customers who have insufficient available funds are automatically suspended and no longer receive the service. Therefore, no subscription charges are generated. As soon as funds become available, the service is resumed and new charges are generated.

An administrator has the authority to suspend service due to insufficient funds for either a specific customer or for an entire customer class.

Let us consider the following example:

The customer has $20 available funds and is assigned a $30 monthly subscription for DID number usage charged a month in advance.

On November 1st the system calculates the subscription charges for the period between November 1st and November 30th ($30) and compares that to the amount of available funds ($20). The available funds are insufficient, thus the customer’s service is immediately suspended.

On November 5th the customer makes a $50 payment, so the available funds now total $70.

The system recalculates the subscription charges. The customer did not use the service until November 5th, so the subscription charges are generated for the period starting November 5th (the day the customer became unsuspended and began using the services again) ending on November 30th ($26). These charges are then compared to the amount of available funds ($70), and applied. The amount of available funds then becomes $44. Therefore the customer’s service is reinstated. (Please see the Invoicing section in the Unified PortaSwitch Handbook Collection for a detailed description of the invoicing process.)

If the customer doesn’t top up their balance in November, the following happens: PortaBilling recalculates the customer’s subscription charges each day to cover the remaining billing period and compares that with the funds available ($20). Since the customer is not charged for the day they are suspended, the sum of subscription charges decreases by the daily fee ($1). As soon as it equals the customer’s available funds ($20), PortaBilling charges the customer and resumes their service.

PortaBilling applies the charge for the whole billing period ($30) and immediately issues a refund for 10 days of suspension. Thus, there are two xDRs produced for the customer: one xDR is for the whole subscription charge ($30) and another is for the refund amount (-$10).

Thus, prepaid customers can only consume services when they have sufficient available funds to cover their next subscription charges.

Subscriptions charged in advance to debit accounts

An administrator can automatically block services for debit accounts when funds are insufficient to cover pending subscription charges.

As soon as an account has sufficient funds (either the administrator makes a payment or the customer tops up an account), the account is charged for the subscription and automatically unblocked. Thus, the customer can continue using the services.

When the account is not charged for the days they do not use the service, PortaBilling will issue a refund for the period during which the account was blocked.

Auto-charging for subscriptions

Another popular business model for applying subscription charges is to automatically deduct them from customers’ credit cards. The service provider maintains a “service balance” for customers, that is, they may only spend their funds on service usage such as international calls, SMS, etc. This prevents situations in which the available funds are consumed by subscription charges.

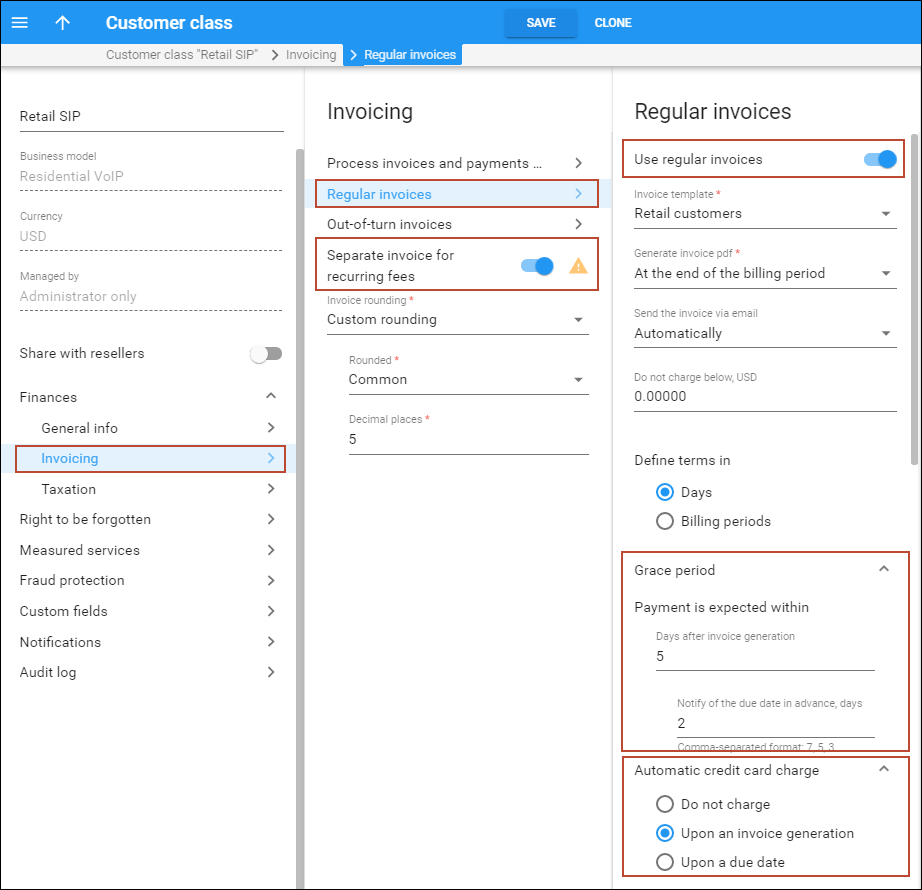

To automatically charge customers for their subscriptions, configure a customer class as follows:

- Enable the Separate Invoice for Recurring Fees option;

- Enable the Automatic credit card charge option;

- Specify the invoice template;

- Specify the grace period in the Payment is expected within _ days after invoice generation option. For example, 5 days;

- Specify when to charge the credit card for the unpaid invoice in the Automatic credit card charge after the due date, days option. For example, 2 days after the invoice due date.

This is how it works:

The sum of subscription charges and calculated taxes for those charges is generated as a separate invoice at the end of the billing period. The invoice amount is automatically deducted from the customer’s credit card, thus leaving the amount of available funds intact.

If the payment transaction is unsuccessful (e.g., if the credit card is expired or there are insufficient funds on it), the invoice remains unpaid and a corresponding notification is sent to the customer.

The customer has some grace period days for updating their credit card information. During the grace period the amount of available funds remains unchanged because a special correction xDR for the sum of the invoice is generated and inserted into the database. Thus, the customer can continue to use other services, such as make international calls.

If credit card information is not updated within the grace period, the customer’s service is suspended until the credit card information has been updated and the payment has gone through.

Consider the following example:

Prepaid customer John Doe has $15 in available funds and signs up for a $10 monthly subscription on April 1st. He is charged 10% in taxes for service usage.

During April, John Doe makes international calls that total $6. His amount of available funds is now $9.

On May 1st two invoices are produced for him:

- An invoice that covers the $10 subscription charge and $1 tax ($10 * 10% = $1). This is an out-of-turn invoice in PortaBilling.

- An invoice that covers $6 for voice calls. Since this is a prepaid customer the invoice status is “do not pay.”

These invoices are mostly used for administrative accounting and are not usually sent to customers.

The sum of the out-of-turn invoice ($10 + $1 = $11) is automatically deducted from John’s credit card so the status of the invoice is “paid.”

In May, John makes international calls totaling $7, therefore his amount of available funds is now $2. The invoices produced for him in June are as follows:

- An out-of-turn invoice that covers his $10 subscription charge and a $1 tax; and

- An invoice that covers $7 for voice calls and has a “do not pay” status.

On May 31st John’s credit card expires, and consequently the out-of-turn invoice is not paid. The correction xDR for the sum of this invoice ($-11) is generated and inserted into the database, leaving the amount of available funds unchanged ($2).

On June 2nd John updates his credit card and the payment transaction for the out-of-turn invoice is successful. The invoice status becomes “paid” and the correction xDR is removed from the database.

If John did not update his credit card, his service would be suspended on June 3rd and terminated on June 18th.

With auto-charging for subscriptions, there is improved cash flow since there is pre-defined recurring revenue.

Customers are better able to control their available funds since these funds are only used for services.

Subscription refunds

A customer may close a subscription prior to the end date of the period that has already been charged for (e.g., the customer already paid for all of May but cancels his subscription on May 20th). Then a refund is issued for the ‘unused’ subscription time (e.g., 11 days).

After the end date of the subscription plan the refund is calculated and immediately applied to the customer’s balance. The refund is reflected on the customer’s invoice at the end of the billing period.

Set conditions for subscription charging when no service was provided

Market environment or local regulations may require that service providers not charge customers when they don’t have access to the service. PortaBilling implements this requirement by charging a full subscription fee and then issuing credits for the days when no service was available. A customer may not have access to the service due to the following conditions:

- The account was expired.

- The account or customer were blocked.

- The customer was suspended.

- No funds were available (the balance of a customer or an individual account reached the credit limit or ran out of available funds).

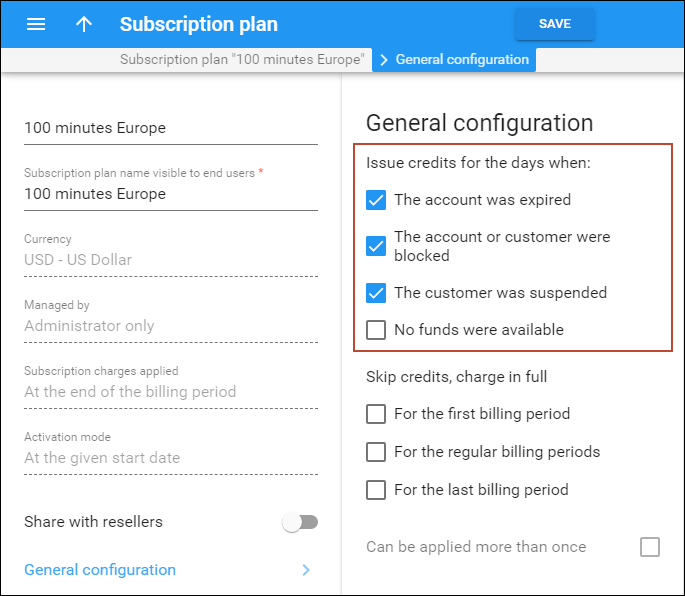

By default, credits for a subscription fee are issued under all the above conditions. Service providers can adjust the default settings and choose under which specific conditions to issue credits for a subscription fee.

Let’s consider an example. The service provider Panda telecom offers 100 minutes of calls to European destinations for a $30 monthly fee. Panda telecom doesn’t charge the subscription fee for the days when customers can’t use the service due to suspension, block, or their account expiration. However, when their balance reaches the credit limit, customers can use the available minutes of the 100-minute quota. Since the they still can access the service, Panda telecom wants to charge the customers the subscription fee when their balance reaches the credit limit (postpaid customers) or runs out of available funds (prepaid customers).

To make this happen, the administrator:

- Goes to Subscription plan > General configuration panel > Issue credits for the days when option.

- Clears the checkbox for the No funds were available condition.

With the Issue credits for the days when option, service providers gain a tighter control over charging subscription fees and thus, can avoid revenue leakage.

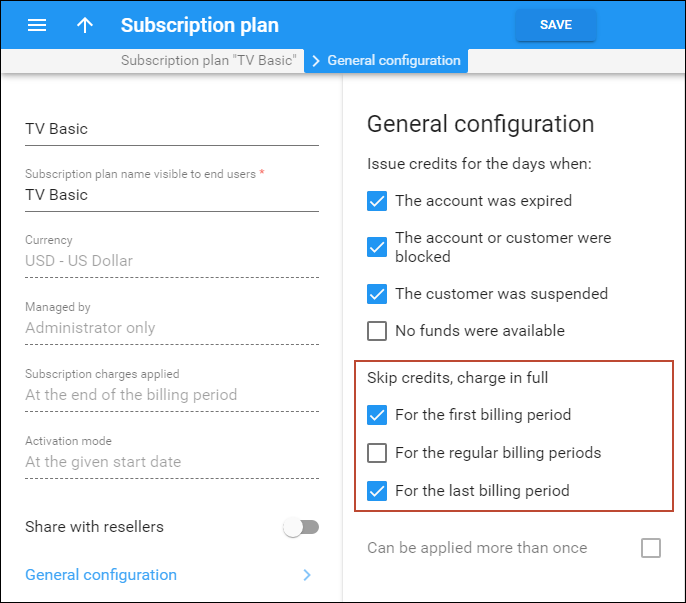

Also, when one or several conditions are set to issue credits for a subscription fee, it’s possible to skip credits for the first, last, or/and regular billing periods.

Let’s consider the example of service provider ABC, which resells their partner’s IPTV services to end users for a monthly subscription fee. The content provider charges ABC a full monthly fee no matter if an ABC customer cancels the subscription or has no access to the service.

To cover the cost, ABC always charges customers a full fee for the first month of the subscription, even if a customer cancels the subscription earlier. If a customer was unable to use the service due to suspension, block, etc. during the first month of the subscription, charges still apply for those days (no credits). This allows ABC to prevent revenue leakage, for example, in situations when a customer signs up for an expensive IPTV subscription only for those days when there are sports competitions and cancels it once a favorite team is eliminated or the competitions end.

However, to encourage customers to continue using the services after a suspension, block, etc. credits are issued for the days when no service was available during the regular billing periods.

To skip credits in the first and last billing periods, the administrator:

- Goes to Subscription plans > General configuration > Skip credits, charge in full option.

- Selects the checkboxes for the first and last billing periods.

Note that the ability to configure this option for the first, last, and regular billing periods separately is available for subscriptions charged At the end of the billing period or In advance. For Progressive (daily) subscriptions you can only enable the option for the whole period, as charges are applied daily.

With the Skip credits, charge in full option, service providers can adjust subscriptions to their business requirements. For example, to balance the cost and revenue side while reselling the partner’s services on a recurring fee basis, they can skip credits and charge a subscription fee in full during some billing periods.

Subscription discounts and markup

Adjust a recurring fee for a specific subscription

You can mark up or discount a recurring fee for a specific account, customer, or reseller (only subscriptions assigned directly). Four options are available:

- Relative discount – a discount percentage that reduces the standard subscription fee, e.g., 20%. A 100% discount means “free service.”

- Relative upcharge – an upcharge percentage that increases the standard subscription fee, e.g., 10%.

- Fixed discount – a fixed amount that reduces the standard subscription fee, e.g., $20.

- Fixed upcharge – a fixed amount that increases the standard subscription fee, e.g., $10.

Note that f a subscription has an empty discount rate, the customer default discount rate is used.

For example, the standard price for a MegaCalls package is $20. The sales manager negotiated with Mary Smith so that she signs up for the MegaCalls package for a $25 monthly price. To define the upcharge, the sales manager performs the following steps:

- opens Mary Smith’s Account > Finances > General info > Subscriptions;

- assigns the MegaCalls subscription > Save;

- clicks Edit for the MegaCalls subscription;

- selects Fixed upcharge in the Periodic fee adjustment option;

- specifies 5 in the Upcharge option > Save .

Note that you can adjust a recurring fee only after the subscription is assigned.

Benefit

Service providers can adjust recurring fees according to their business needs.

Implementation specifics

- A fixed upcharge/discount can’t be applied to subscriptions that are charged progressively (Keep total charge only xDR generation mode).

- The upcharge/discount can’t be applied to multi-month prepaid plans.

Customer discounts

To simplify the management of different discount tiers (e.g., all your “silver” customers get 10% off the monthly fee for any of their subscriptions) you can directly assign a discount rate to a customer. So instead of creating multiple subscription plans with different periodic fee values, you will have a single set of subscription plans. You can then simply assign discount rates (10%, 20%, etc.) to customers. Any subscription (either directly applied to the customer or associated with one of the customer’s accounts) that does not have an explicitly assigned discount rate will then be charged using this discount.

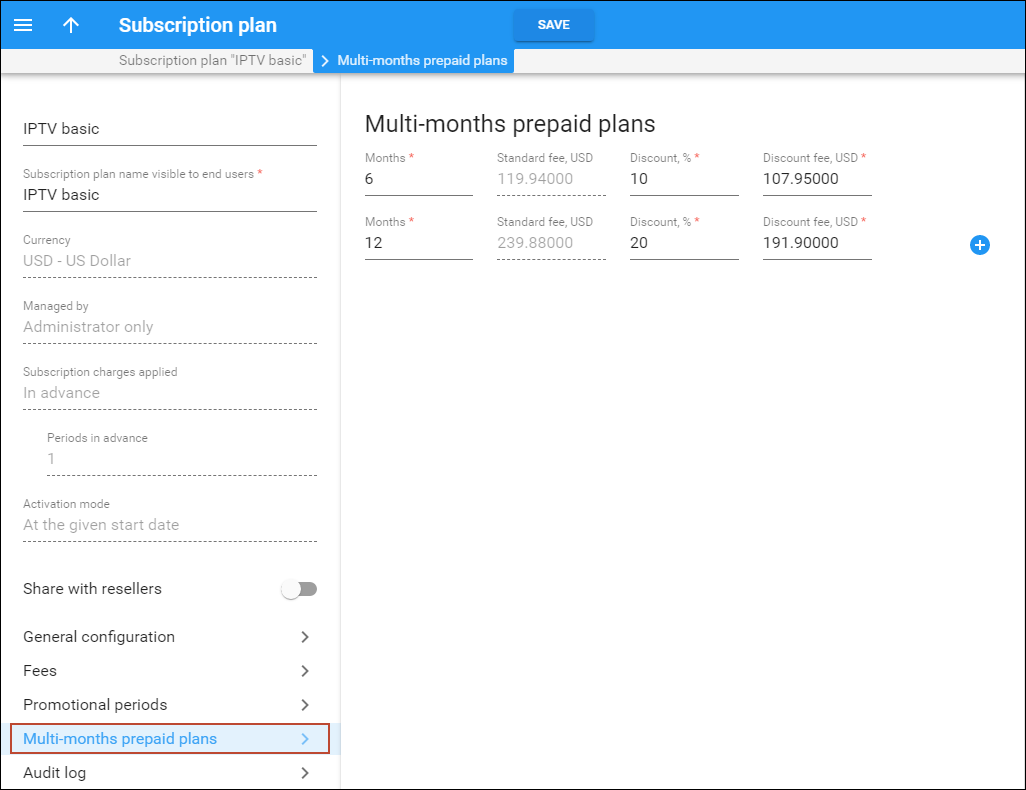

Prepaid plans for subscriptions charged in advance

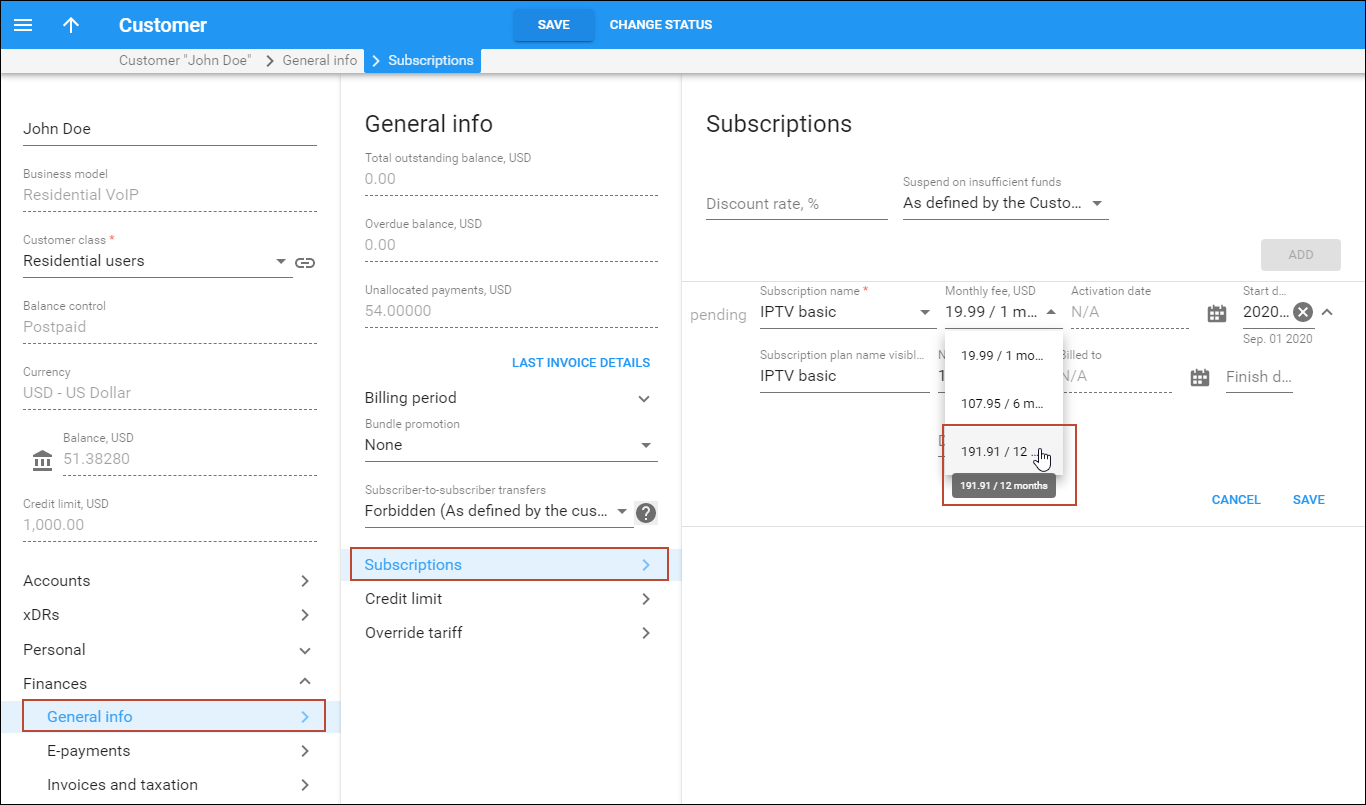

To improve your cash flow, you can encourage your customers to pay money in advance by offering them different prepaid plans within subscriptions that are charged in advance (e.g., “Pre-pay for 6 months and get 20% off for Internet” or “Pay for 12 months and save $100 for IPTV!”). An administrator can set the number of months and choose a discount value, which will either be a percentage (e.g., 20%), or a fixed sum (e.g., $20).

Then when assigning a subscription to a customer or an account, a corresponding prepaid plan can be selected. Consider the following example: in October 2015 customer John Doe signs up for the IPTV service with a $19.99/monthly fee charged in advance. He has two options for paying for the service:

- 10% discount for 6 months ($19.99*6 – 10% = $119.94 – $11.99 = $107.95);

- 20% discount for 12 months ($19.99*12 – 20% = $239.88 – $47.98 = $191.90).

John Doe chooses the 12-month payment plan so he is charged $191.90 and saves $47.98 (i.e., an xDR with this sum is created and inserted into the database). These charges are then reflected on his October invoice. Moreover, he is not bothered with monthly payments until the end of the prepaid period (his invoices for the next 11 months will not include subscription charges since they have already been paid). The next subscription charge will occur in 12 months’ time (i.e., in October 2016.) Thus, customers have the option to choose how to pay for their services. When paying months in advance, they receive a discount on services and, as a result, save money. ITSPs in turn improve their cash-flow, charging their customers for several billing periods at once and receiving larger sums as advance payment.