Customer class allows you to define a policy for gradual and automated payment collection.

Important dates

- Issue date defines the moment when an invoice was issued.

- Invoice grace period indicates the period (in days or billing periods) following the invoice issue date for a payment to be received. The invoice due date is calculated as invoice issue date + grace period. For example, if the issue date is June 1 and the grace period is 15 days, the invoice must be paid before June 16. The grace period can be zero, in which case the invoice is considered to be due upon receipt.

Gradual payment collection

You can gradually enforce outstanding payment collection. Step-by-step service deactivation encourages customers to pay their invoices on time and helps you maintain positive relationships. You also receive additional revenue for each overdue invoice by applying service reactivation and late payment fees. The process of outstanding payment collection may include four steps. Each step is optional, independent from other steps, and can be configured individually. You can use one, two, or all of them if necessary. The description below demonstrates the way the payment collection process works when all four steps are configured:

- Service limitation. If a customer fails to pay invoices issued for services, the customer’s status changes to “Service limited.” This means that the customer can still use the services, but in a restricted capacity. For example, instead of the standard 100Mbps package, a customer can only use 1Mbps. While the service is limited due to non-payment, recurring charges still apply. A late payment fee is charged each time a new invoice becomes overdue. Service limitation can be lifted upon customer payment – or the next step is activated (e.g., customer suspension).

- Customer suspension. If invoices are still not paid within the limitation period, the customer’s status changes to “Suspended.” While suspended, the customer can no longer use the services and is charged a late payment fee each time a new invoice becomes overdue. In this case, recurring charges do not apply. The customer can resume using the services when they pay in full for all the overdue invoices that caused the suspension. Once that happens, a reactivation fee applies and the customer can use the services again.

- Сommitment termination for all accounts. If invoices are not paid within the service suspension period, customers benefiting from a discounted subscription rate (a so-called “commitment”) lose the discount. Services within these commitments are no longer provided. To renew the services, customers are required to repay the full cost of service backdated from the start of the commitment.

- Customer termination. If invoices are not paid within the previous period (commitment termination takes place), the customer record is closed and can no longer be activated.

Let’s take a look at an example where the option for payment collection is set in days and only the suspension and termination options are configured: David, your customer, has a grace period of 21 days, a suspension time of 14 days, and a termination time of 21 days. David’s invoice was generated on May 1st, so the invoice due date is May 22nd. If David does not pay by that date, the invoice becomes overdue; 14 days (2 weeks) after that, on June 5th, his account becomes suspended; and on June 12th, 21 days after the due date, or one week after the suspension date, his account is permanently closed. The administrator can set the following options to configure the payment collection process:

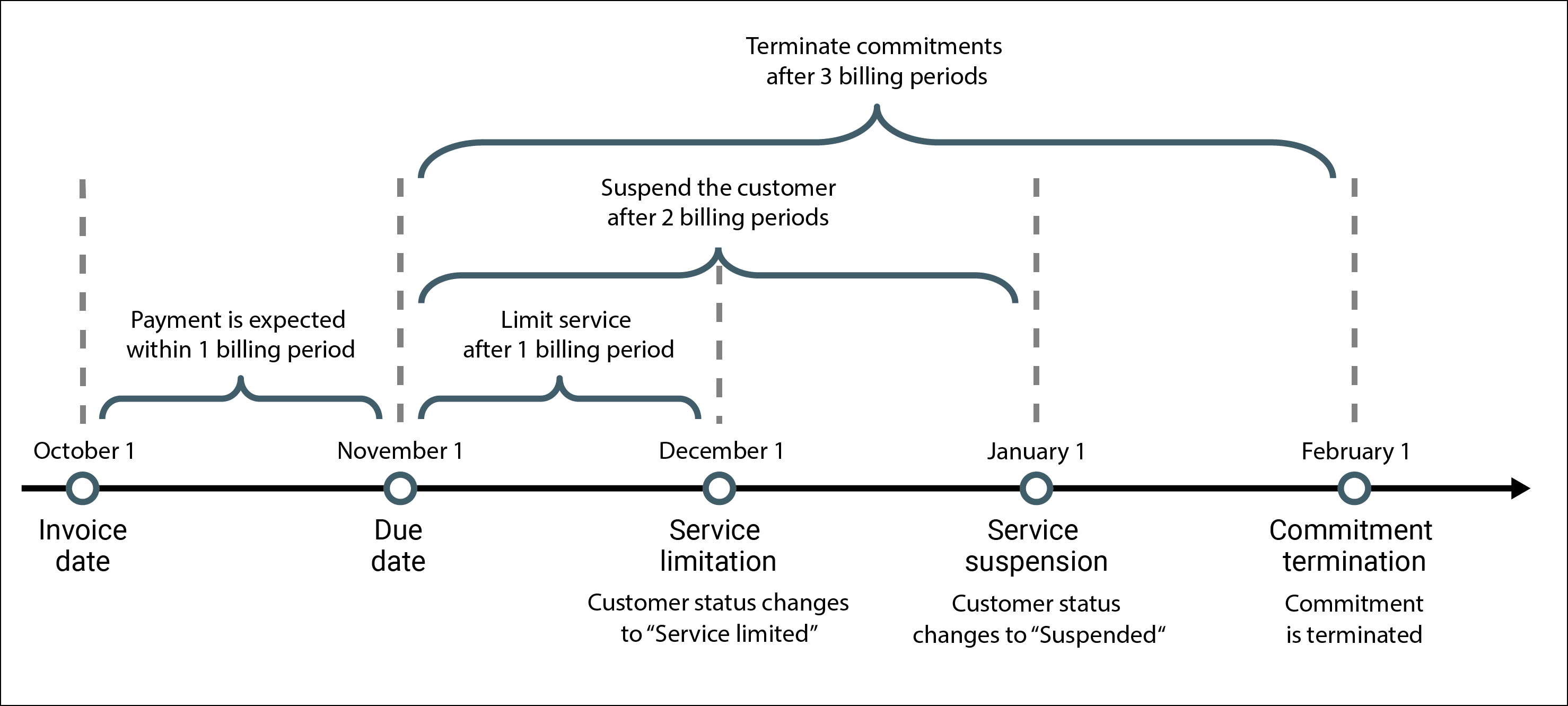

- Payment is expected within billing periods after invoice generation – this period is called the grace period. The due date of the invoice is calculated as follows: the invoice issue date + the grace period. For example, if the issue date is October 1 and the grace period is 2 billing periods, the invoice must be paid before December 1 (for a monthly billing period).

- Late payment fee – this is a fixed fee that applies each time a new customer’s invoice becomes overdue (the fee is included in the next invoice). It applies immediately, so the customer is charged this fee even if they pay the overdue invoice a few hours later.

- Limit service for customer after the due date – the number of billing periods after the due date when the customer receives the “Service limited” status. Once a customer is limited, their services are restricted but recurring fees still apply.

- Suspend the customer after the due date – the number of billing periods after the due date when the customer receives the “Suspended” status. When a customer is suspended, their services are blocked but no recurring charges apply.

- Reactivation fee – a fixed fee that applies each time the customer pays all their overdue invoices (that caused the suspension). The reactivation fee is included in the next invoice.

- Terminate commitments for all accounts after the due date – the number of billing periods after the due date when all account commitments are closed (terminated). Accounts can no longer use services/features provided within the commitments. Other services remain active.

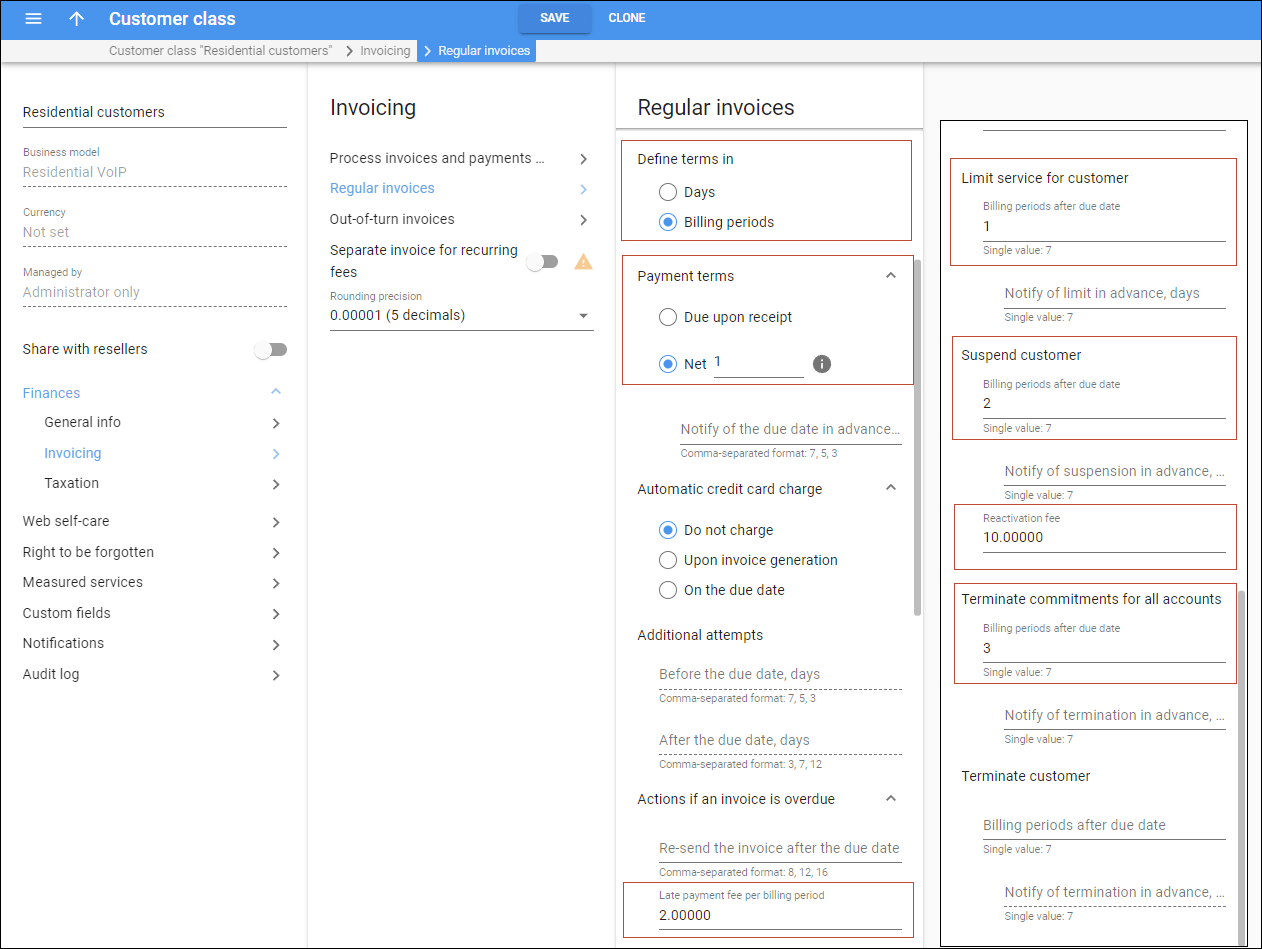

For example, to define the payment collection settings (grace period, service limitation and customer suspension, etc.) for residential users, the administrator performs the following steps:

- Opens Customer class > Invoicing > Regular invoices.

- Defines terms in billing periods.

- Defines that payment is expected within 1 billing period.

- Specifies a late payment fee of $2 on an overdue invoice.

- Sets to limit service for customer in 1 billing period after the due date.

To limit services immediately on the due date, set “0” for the Limit service for customer option.

- Sets to suspend customer in 2 billing periods after the due date.

- Sets a $10 reactivation fee.

- Sets to terminate commitments for all accounts in 3 billing periods after the due date.

The configured payment collection schema illustrates the following timeline:

Let’s see what happens if John Doe doesn’t pay for his Turbo 100Mbps commitment for several months and tries to continue to use the services after suspension.

| Date | Description |

|---|---|

| October 1 | John Doe receives a $20 invoice for his Internet service for September. |

| November 1 | John Doe hasn’t paid for the services.

|

| December 1 | John Doe still hasn’t paid for the services.

|

| January 1 | John Doe still doesn’t pay for the services.

|

| January 25 |

|

| February 1 |

|

Let’s see the alternative outcome when John Doe pays only $25 (not $86) on January 25. Though the September invoice ($20) is paid in full, services become limited due to the partially-paid (overdue) October invoice ($5). A reactivation fee is applied and then John’s status changes from “Suspended” to “Service limited.”

Benefits

Service providers can stimulate their customers to pay for their services on time. An administrator can define conditions and penalties (late payments fees, reactivation fee limitations) that apply in relation to unpaid invoices for a particular customer class all in one place.

Shift the date for service limitation/suspension

When service limitation/suspension takes place during a holiday (a region-wide day off) or a weekend, some customers request services to be turned back on and promise to pay once the holiday is over. However, there are usually fewer employees to process such requests during weekends and holidays, so to decrease their load; configure an automatic shift in the service limitation/suspension date (to weekdays instead of weekends and public holidays). To accomplish this, the administrator performs the following steps:

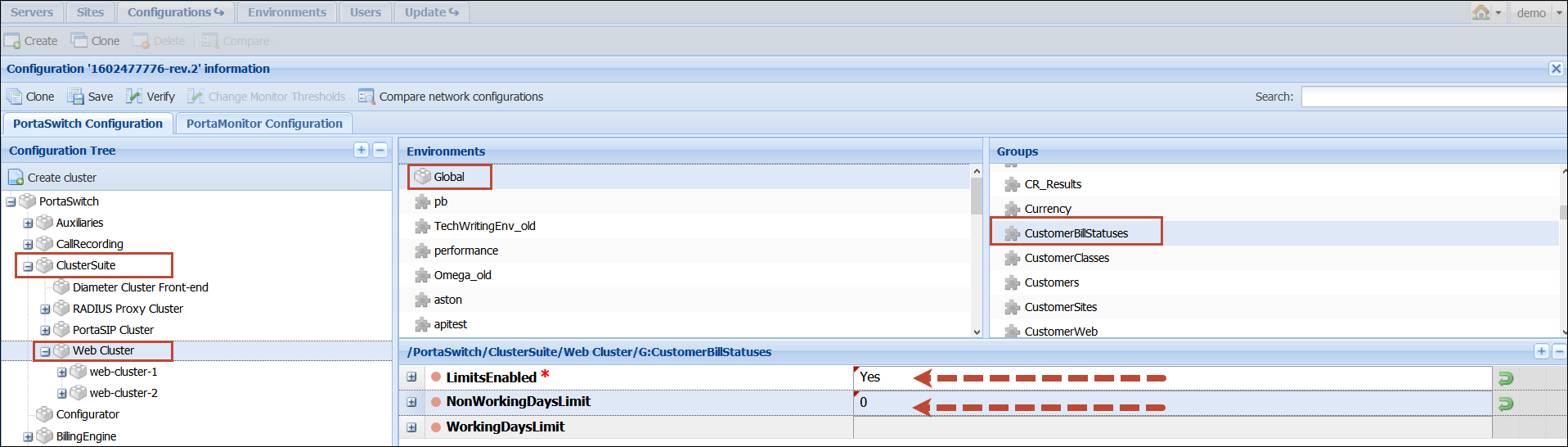

- Goes to the Configuration server > ClusterSuite > Web cluster.

- Selects Global environment > CustomerBillStatuses group.

- Enables LimitsEnabled option.

- Sets “0” for NonWorkingDaysLimit option. This means that all customers will only be limited/suspended on weekdays.

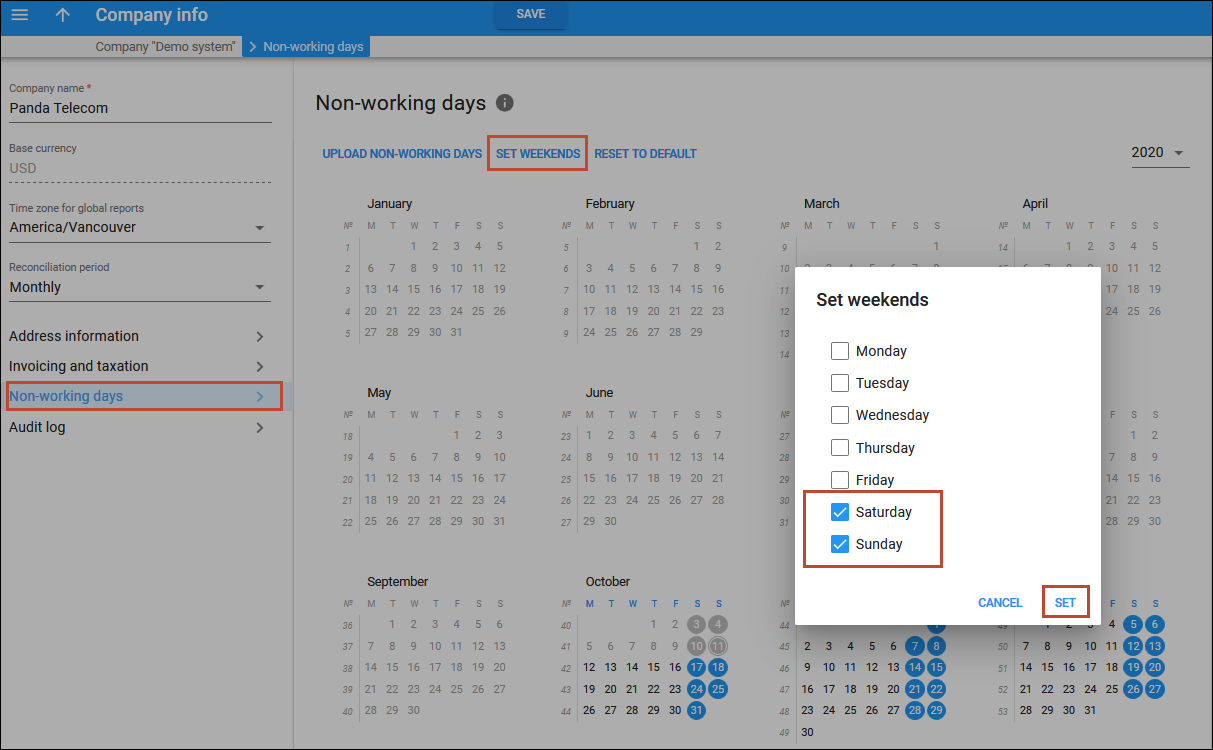

- On the PortaBilling web interface, opens My company > Company info panel.

- Selects Non-working days panel.

- Selects Set weekends option and checks Saturday and Sunday in the dialog window.

- Selects public holidays on the calendar manually or uploads a file of non-working days in .csv format.

For example, Mary Smith didn’t pay her previous invoices, so on Sunday her services are suspended. Since it is set as a non-working day, Mary’s suspension automatically shifts to Monday so that on Sunday, Mary can use the services. On Monday, her services are suspended. Mary doesn’t pay her invoices, so her commitment will be terminated. The date of termination falls on a Saturday. Mary’s commitment is terminated, since date shifting only works for service limitation or suspension.

Reschedule the Service limited/suspended status manually

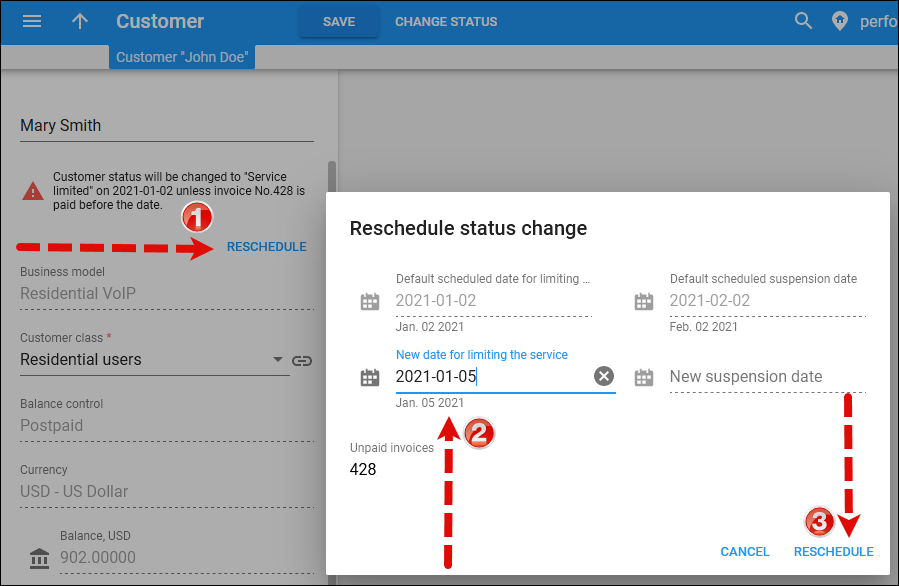

When customer services are going to be limited or suspended (customer has an overdue invoice), the administrator sees a notification on the customer’s record. This notification shows the date the customer status will change and the invoice(s) number that caused limitation/suspension. An administrator can reschedule the service limitation/suspension date manually. To accomplish this, the administrator performs the following steps:

- opens Mary Smith’s record;

- clicks Reschedule;

- selects a new date for customer limitation/suspension in the dialog window; and

- clicks Reschedule in the dialog window.

Automated payment collection

You can automate customers’ invoice payments by charging their credit cards. This saves customers’ time and prevents having their service suspended since their invoices are always paid automatically and on time. You can charge customers’ credit cards either immediately upon invoice generation or on their due date.

Upon invoice generation

When a customer’s billing period closes, PortaBilling calculates their charges, creates their invoice, and charges their credit card. After successful payment processing, PortaBilling generates their .pdf invoice file with a zero amount due and the Paid in full status.

Upon invoice due date

In this case, PortaBilling generates the invoice .pdf file and sends it to the customer. During the specified grace period, the invoice remains unpaid. On the due date, PortaBilling charges the customer’s credit card for the complete invoice amount. A customer can pay for an invoice earlier, either partially or in full. If the payment is partial, PortaBilling charges the customer’s credit card for the remaining amount on the due date. To have a closer look at how customers are charged on their invoice due date, consider these examples:

Regular invoices

EasyCall pays their invoices 30 days after its issue. On February 1, EasyCall receives their January invoice with $100 due and the due date for this invoice is March 2. EasyCall uses the service for the whole of February and receives a new invoice with $80 due on March 1. On March 2, PortaBilling charges their credit card for $100 to cover the January invoice and on March 31, PortaBilling charges them for $80, as that is the due date for their February invoice.

Out-of-turn invoices

You can collect delayed payments for out-of-turn invoices, too. The grace period for out-of-turn invoices is 10 days. On June 10, EasyCall receives an out-of-turn invoice for their equipment rental. On June 20, PortaBilling charges their credit card for the invoice amount.

Re-collection attempts

If an initial payment is unsuccessful for some reason, PortaBilling can try to charge the customer’s credit card again (refer to the Re-collection attempts section for details). Let’s say you have configured a re-collection attempt for 20 days after the due date. On April 1, EasyCall receives their invoice for March 1-31 with an amount due of $100. This invoice’s due date is May 1. PortaBilling charges the customer’s credit card for $100 but the payment fails so the invoice becomes overdue. On May 1, EasyCall receives a new invoice for April 1-30 with a $150 amount due. Then on May 21, 20 days after the March invoice due date, PortaBilling again charges the credit card for $100. The payment fails again so the invoice remains overdue. May 31 is the due date for the April invoice. The total outstanding balance is now $250, since it includes the previous balance for the March invoice ($100) and the April invoice’s one ($150). This time, PortaBilling charges the credit card for $250 and since the payment is successful, both invoices become Paid in full. To automatically charge customers’ credit cards for invoice amounts:

- Configure a payment system in PortaBilling;

- Enable the Automatic credit card charge option for the customer class;

- Specify what the grace period is and for how many days after the invoice due date re-collection attempts will be made;

- Make sure customer’s credit card details are saved in PortaBilling and activate automatic charging for invoices.

Collection threshold

In case a customer has not actively used the service and his invoice amount is very low, (e.g., less than $1) it does not really make sense to follow the normal collection process and request payment for that amount. So if the amount due on a new invoice is lower than the specified threshold – no payment is yet required. If no payment is made, the balance is applied to the next invoice, etc. until the amount due on a new invoice crosses that threshold. When full payment is made for these outstanding invoices, it will be applied to all the open invoices and then they will be considered paid.

Notifications regarding payment due

Since it may happen that a customer has lost or overlooked the original invoice, PortaBilling can send automated notifications to a customer several times before the invoice due date, stating that payment has still not been received. You can configure any set of days, e.g., “10,7,1” will send notifications 10 days, 7 days, and 1 day prior to the invoice due date.

Overdue invoice notifications

When an invoice is past its due date, PortaBilling will continue notification attempts, but in this case, using a different notification text. Here again, you have complete freedom in configuring this notification policy: for instance, “0,7,14” will send an alert to the customer on the due date, and then 7 and 14 days later.

Re-collection attempts

It could be that the initial attempt to charge a customer’s credit card has failed due to a temporary problem (e.g., he exceeded his credit limit, having recently made a very expensive purchase, but has now paid his credit card bill). In such a case, it would be useful to try charging his card sometime later. However, since the merchant bank will usually charge you for every failed credit card transaction, this should not be done too often. In the customer class definition you can specify when re-collect attempts should be made, e.g., “0,3,7” means that PortaBilling will attempt to charge the customer’s credit card on the due date, 3 days after the due date, and 7 days after the due date.

Suspension warning time

As a last resort to prevent service interruption, PortaBilling will send another alert to the customer prior to service suspension. This parameter may also be configured in the customer class definition.

Closing warning time

In the case that an invoice is not paid in full after service suspension, a reminder notification will be sent to the customer stating that his account is about to be permanently closed.

Customer account during collection

When a customer has an unpaid or overdue invoice, all call services are rendered as usual, subscription fees are charged for the current period, and new invoices are generated (for instance, if your customer has net payment terms of 60 days, he may have two other (newer) invoices generated by the time his invoice becomes overdue). When a customer has suspended status, his call services are blocked, but some subscription fees are still applied (since his account is being provisioned, e.g., his voicemail is kept on the server). When the customer’s account is closed, no further activities, be it calls, subscription fees, self-care access, or any other, are available for his account.

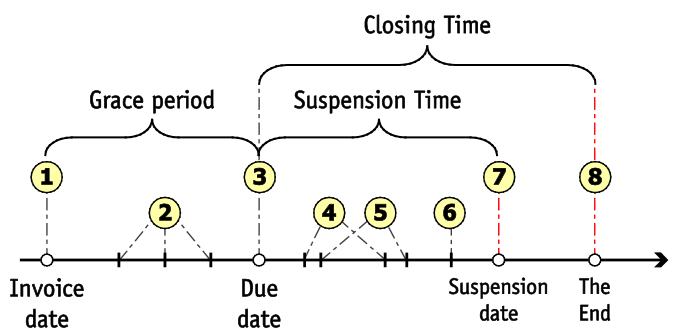

Collection process

- At the end of the billing period an invoice is generated (1).

- If the invoice has a positive amount due, it is considered unpaid. When the invoice status is unpaid, a customer may be reminded of the approaching due date (2).

- On the due date, the unpaid invoice becomes overdue (3).

- Several collection attempts may be made (attempts to charge the customer’s credit card on file for the amount due) (4).

- The customer may be reminded that the invoice is overdue (5) and that service may soon be suspended (6).

- On the suspension date, the customer’s status changes to suspended (7), which automatically blocks his access to services.

- If the payment issue is not resolved, the customer’s account is closed on the closing date (8).

In some cases, after the customer is suspended, and thus finally realizes that there is an unpaid invoice(!), he needs some extra time to submit payment. In this case, his suspended status may be temporary lifted by the administrator. The administrator will revert the customer’s status to normal and specify the date until which suspension is postponed. If the invoice is not paid in full by that date, the customer will be automatically suspended again.

Void invoices

It sometimes happens that an error is detected after an invoice has been generated and delivered to the customer. A new invoice must be produced, but the old one must be kept for audit purposes. The void invoice operation marks the invoice as canceled (this will also be visible in the .pdf file), and then a new invoice is automatically produced.

Invoice recalculation

This process voids an existing invoice and generates a new one in its place.

Invoices review

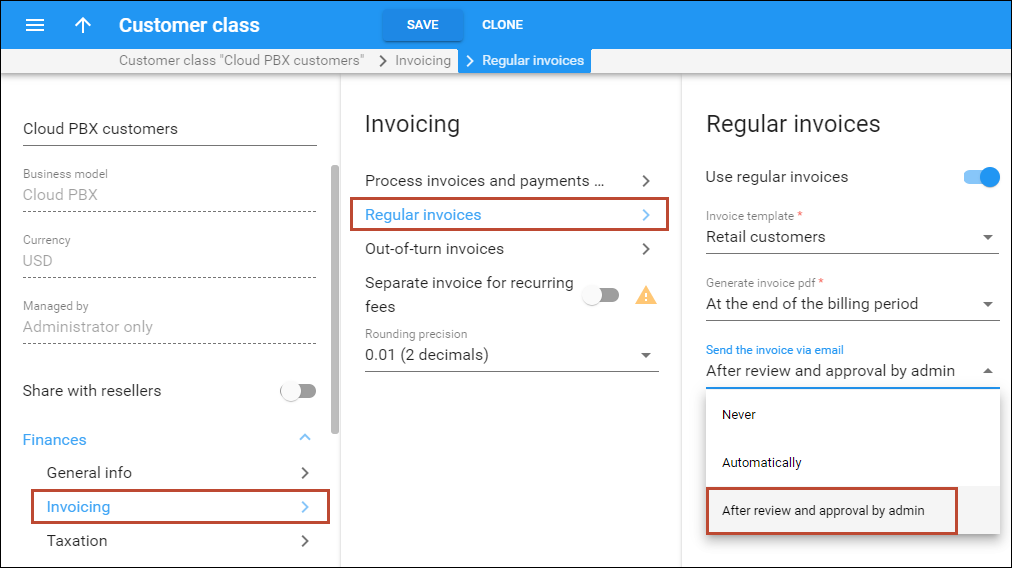

In order to provide your customers with correct invoices, PortaBilling allows you to review invoices before sending them to your customers. The administrator reviews the invoices and then approves them, or if necessary, performs balance adjustments (for example, to correct an invoice total) or sends them to be regenerated (if, for example, the administrator has additional reasons to update the invoice). Only after that step, the invoices are delivered via email to your customers. You can enable this feature for a specific customer class. At the end of the billing period, the invoices will be created but not yet sent to the customers, pending approval.

The review status of an invoice is displayed as part of the invoice record in the database. The following statuses are possible:

- Under review – a created invoice requires an administrator’s approval. The administrator can filter invoices by Under review status on the web interface.

- Approved – the administrator has approved the invoice and it is automatically sent to a customer via email. The invoice keeps the Approved status on the web interface until one of the payment statuses is applied. For instance, the Approved status changes to Unpaid or Paid.

- Rejected – if the administrator chooses to re-issue the invoice and postpones its processing to the nearest off-peak hours, the invoice status is Rejected until the processing is done. Once the invoice is re-issued, the status is Under review again, and the invoice is available for re-approval.

The invoices review functionality can be used for the following situations:

- Billing of premium customers – with your premium customers, you naturally want to provide them with high-quality services. Invoices are no exception. You want to be sure that all charges are included and that the invoice total is calculated accurately.

- Billing of a new service – an administrator creates a new service with new ratings, tariffs, products and invoice templates. If they are not sure whether all the new charges are correctly calculated they can activate the Send invoice after review and approval by administrator option for the specific customer class. Only after the administrator checks and approves the invoices are they delivered to customers via email.

- Changes in templates – if during invoice review an administrator discovers that a template must be adjusted, they change the template. Then on the Invoices page the administrator selects all of the “under review” invoices that were created using this template and regenerates new ones. They are then sent for a second review.

If the “auto-charge credit card” functionality is enabled together with the “review invoices” functionality, then the credit card will be charged after the administrator’s approval of the invoice. To prevent situations where invoice review has not been performed there is an additional field that defines how many days the invoices remain under review before they are auto-approved by PortaBilling. Each day administrators, who belong to the corresponding mailing list, receive an email with a list of all the invoices to be reviewed. If an invoice is not reviewed by the end of the specified period, it is automatically approved and sent to the customer. An email with a list of all auto-approved invoices is sent to the administrators who belong to the corresponding mailing list.

Back-dated charges for invoices under review

When an administrator reviews invoices he can apply balance adjustments to be included on the current invoice. He specifies the amount and the date of the balance adjustment that is covered by the most recent billing period. Consider the following example: The administrator reviews invoice #123 for March 2015 with an invoice total of $150, notices a human error (a $100 subscription is charged, but it should have been free this month according to the agreement). He can click the Refund button and apply a $100 credit to the customer. The invoice is then automatically scheduled for recalculation/regeneration. After that, the invoice shows a credit of $100, and the total is changed according to this transaction. As a result, the invoice total is $50.