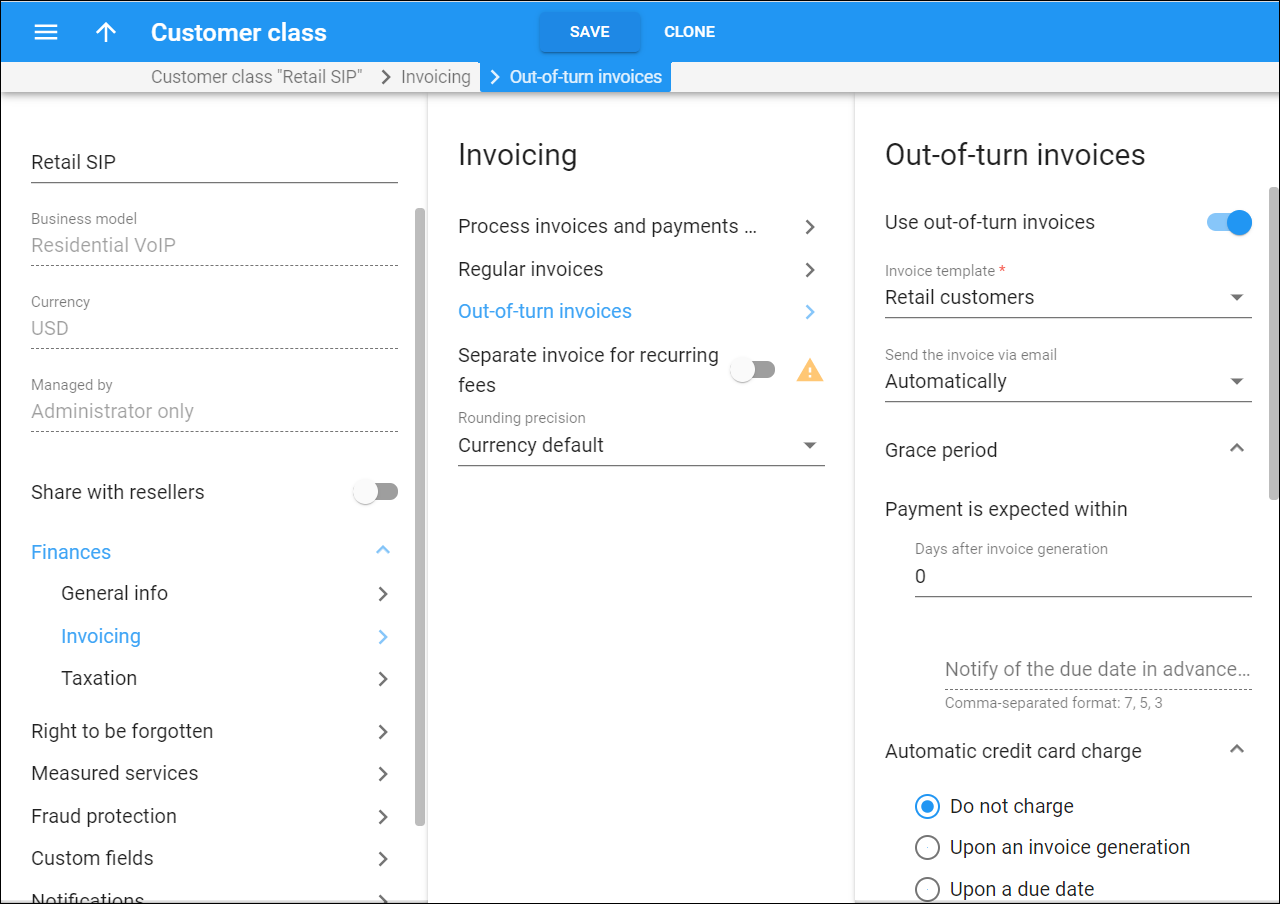

With out-of-turn invoices you can immediately charge customers for the services provided (e.g., equipment rental) and receive payments. Out-of-turn invoices are generated for customers on demand.

Here you can enable out-of-turn invoicing for customers and configure the invoicing parameters, payment terms and collection policy for them.

Use out-of-turn invoices

Turn on the toggle switch to enable out-of-turn invoices for customers. The toggle activates other configuration parameters.

Invoice template

An invoice template is the special HTML document that defines how your customers’ .pdf invoices look. You create invoice templates on the Templates panel. Then you select the desired invoice template from the list.

You can use different invoice templates for regular and out-of-turn invoices. The Do not create an invoice value means PortaBilling only produces xDR summaries for the customers and doesn’t generate .pdf invoices.

Send the invoice via email

Define when to send out-of-turn invoices to a customer by email:

- Never – customers won’t receive their .pdf invoices by email.

- Automatically – PortaBilling creates a new invoice for a customer and automatically sends the PDF .pdf copy to them by email.

Grace period

Payment is expected within

This is the number of days after invoice generation during which a customer must make a payment. This period is called the grace period. The invoice due date is calculated as the invoice issue date plus the grace period. For example, if the issue date is June 1 and the grace period is 15 days, the invoice must be paid before June 16.

The default value is zero. This means that the invoice is considered due upon receipt.

Notify of the due date in advance, days

Specify how many days before an invoice is due a customer receives notification. This option activates if the grace period is more than zero days; its value must be lower than the grace period.

You can send several notifications: specify comma-separated values in descending order (e.g., 7, 5, 3). For instance, “14, 7, 3” means that the customer receives notification 14, 7 and 3 days before the due date. (Obviously, if the customer pays after the first notification, no further notifications are sent.)

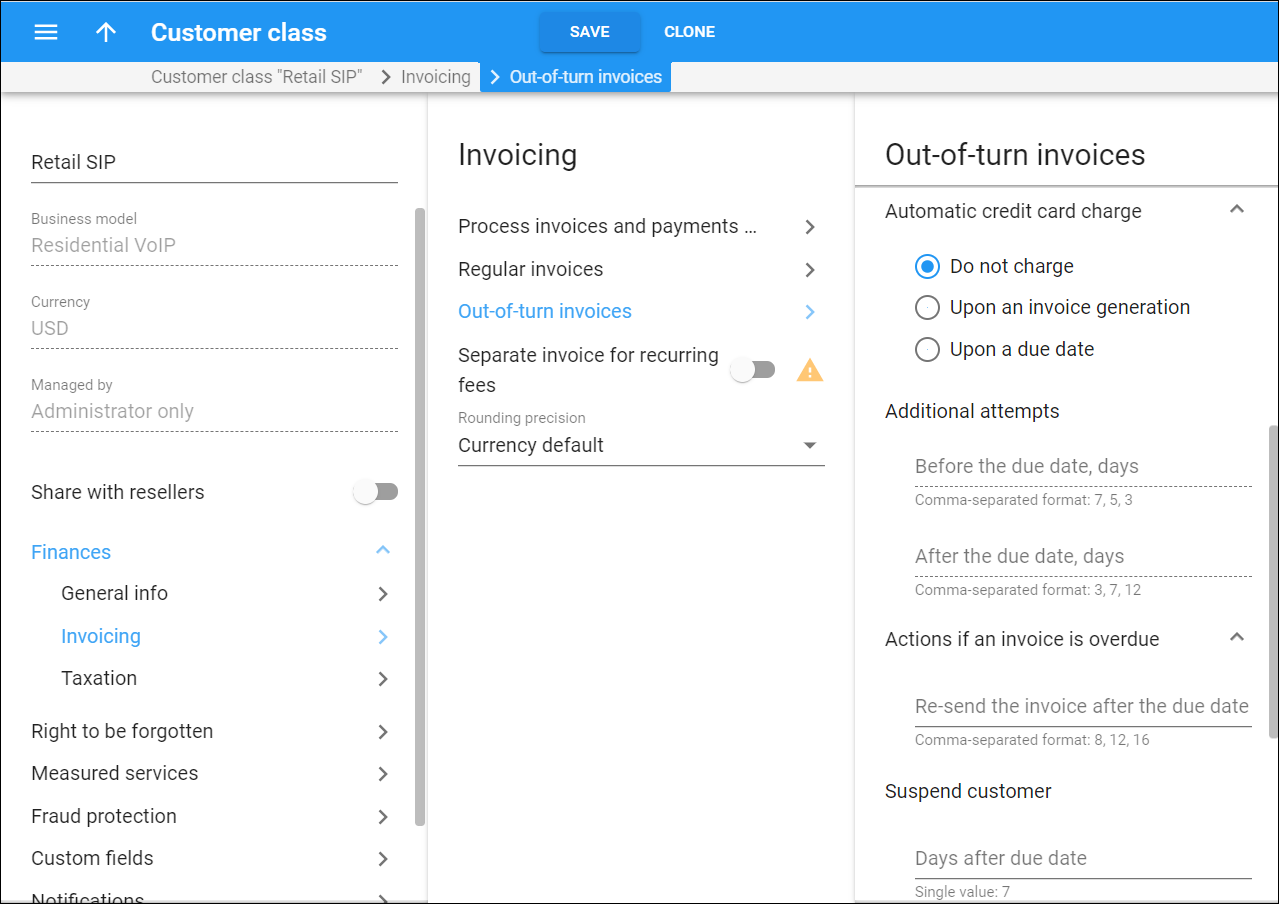

Automatic credit card charge

To improve the cash flow, you can automatically charge customers' credit cards for invoice payments.

- Upon an invoice generation – at the end of the customer’s billing period, PortaBilling calculates an invoice and immediately charges the customer’s credit card. Upon successful payment processing, PortaBilling generates an invoice .pdf file with a zero amount due. If the payment transaction is unsuccessful, PortaBilling generates the .pdf invoice with the actual amount due.

- Upon a due date – you must specify the grace period for this charging mode. At the end of a customer’s billing period, PortaBilling generates a .pdf invoice and sends it to the customer. The invoice status remains Unpaid during the grace period. On the due date PortaBilling charges the customer’s credit card. Upon successful payment processing, the invoice status becomes Paid in full. Otherwise, it becomes Overdue.

Additional attempts

Schedule the next attempts to charge customer credit cards if the initial payment was unsuccessful.

Before the due date, days

This option works if you selected to charge customers' credit cards immediately Upon an invoice generation. Specify when PortaBilling attempts to re-collect customer payments after the unsuccessful initial transaction but before the invoice due date.

Several attempts are possible. Specify the values separated by commas and in the descending order (e.g., 4, 2, 0). A zero value means to charge again on the due date.

To disable re-collect attempts completely, leave this field empty.

After the due date, days

Specify how many days after the invoice due date PortaBilling will attempt to re-collect the customer payment. Several attempts are possible. Specify the values separated by commas and in the ascending order (e.g., 0, 2, 4)

For instance, "0, 3, 10" values instruct PortaBilling to charge the customer’s credit card on the due date and again 3 and 10 days later. (Obviously, if one of the charge attempts succeeds, no further attempts will be made).

To disable re-collect attempts completely, leave this field empty.

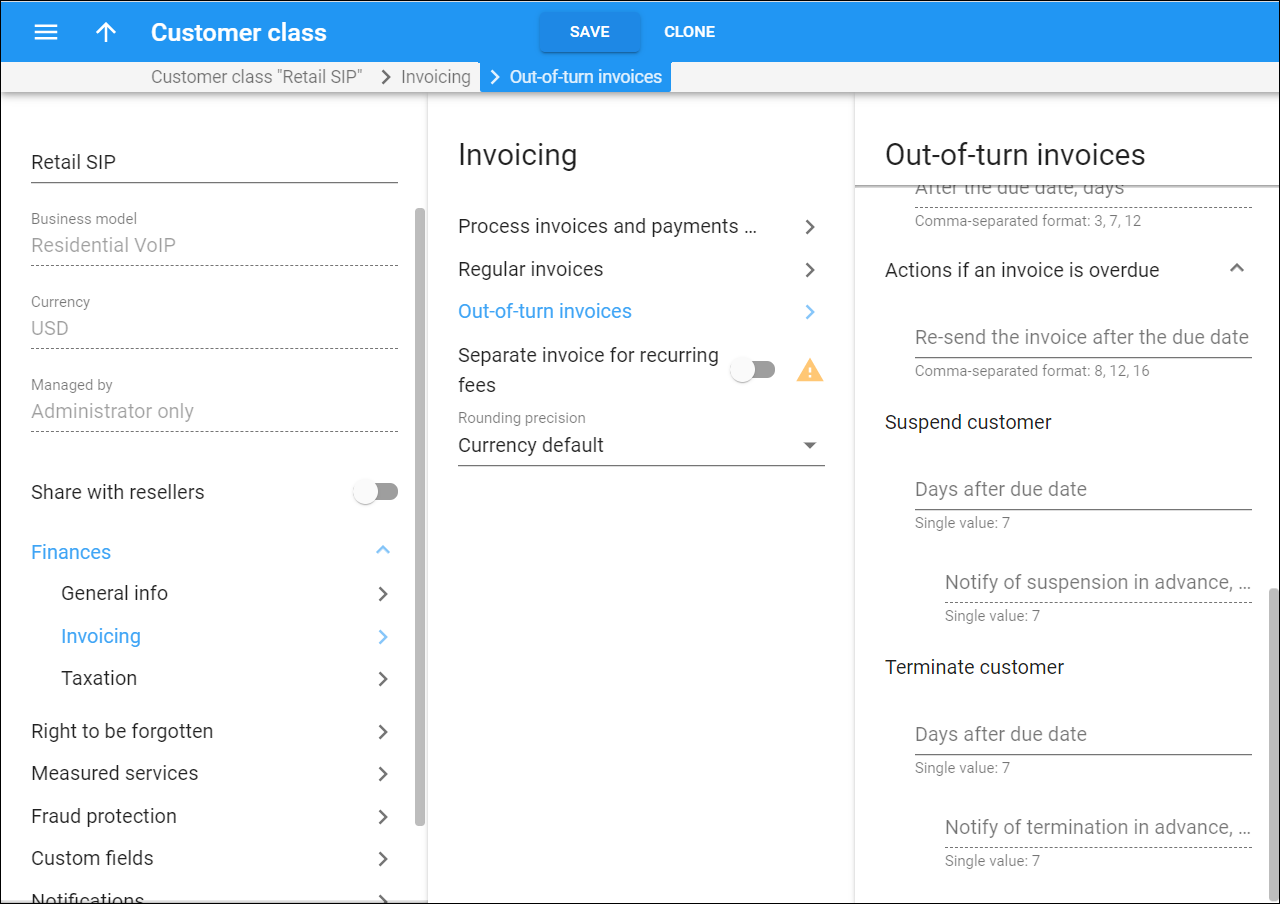

Actions if an invoice is overdue

Configure how to deal with customers upon non-payment

Re-send the invoice after the due date

Send a notification regarding the overdue invoice to a customer. Specify how many days after the invoice due date that a customer receives such a notification. An empty field disables these notifications.

You can define several thresholds to send multiple notifications to a customer. Specify values separated by commas and in the ascending format (e.g., 10, 12, 15).

For instance, "0, 7, 14" values mean that the customer receives a notification on the due date and again 1 and 2 weeks later. (Obviously, if the customer pays after the first notification, no further notifications will be sent).

Suspend customer

Days after due date

You can suspend a customer if their invoice remains unpaid. When a customer is suspended, their services are blocked though some subscription fees may still apply (this depends on the subscription configuration).

Specify the suspension period. This is how many days after the due date that the customer becomes suspended. The minimum value is 1 day. The empty field means no suspension applies.

Notify of suspension in advance, days

Specify how many days before the suspension date to send a notification to the customer. The value here must be equal to or lower than the suspension period.

Terminate customer

This option is used to permanently terminate a customer’s record if they fail to make a payment covering all their overdue invoices within a set period after the due date.

Days/Billing periods after due date

Specify the number of days (or billing periods, depending on the Define terms in option) after the invoice due date when the customer record becomes permanently terminated.

For example, you specify “60 days” here. The invoice due date is September 1st, and on this day the invoice becomes overdue. If the customer doesn't pay for this invoice (and all other overdue invoices) within 60 days, their customer record will be terminated on October 31.

Note that this value must be greater than the number in the Suspend customer > Days/Billing periods after the due date field.

Notify of termination in advance, days

You can notify customers about the approaching termination. Specify how many days before the permanent termination date to send a notification to a customer.

If you define payment terms in days, the number that you specify here must be equal to or less than the number in the Terminate customer > Days after due date field.

The minimum value is 1.