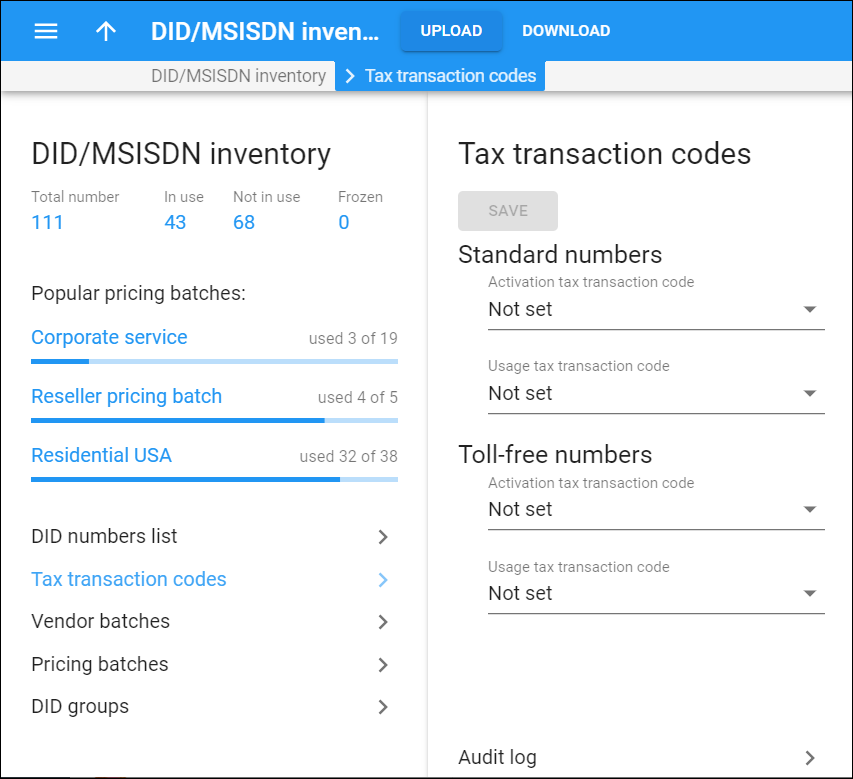

On this panel you can configure automatic tax calculation for DID numbers’ charges via Avalara, EZtax, SureTax and GST taxation plug-ins. PortaBilling then includes the calculated tax amounts on customers’ invoices along with other taxes.

Calls to standard and toll-free DID numbers are charged differently (the calls to toll-free DID numbers are free of charge for the calling party). Thus, go to the Taxation section and add different internal tax transaction codes for standard and toll-free DID numbers on the Tax transaction codes panel.

First, map them to the plug-ins’ tax transaction codes.

Then go back to the DID inventory and specify those codes in the Activation tax transaction code and Usage tax transaction code fields for standard and toll-free DID numbers accordingly.

At the end of the billing period, the taxation plug-in(s) calculate taxes for DID numbers’ charges according to the tax transaction codes defined in the DID inventory.

Click Save to apply the configuration.

Audit log

On the Audit log panel you can track and browse the changes made.