A service defines the naming and billing parameters of the physical service you provide to customers.

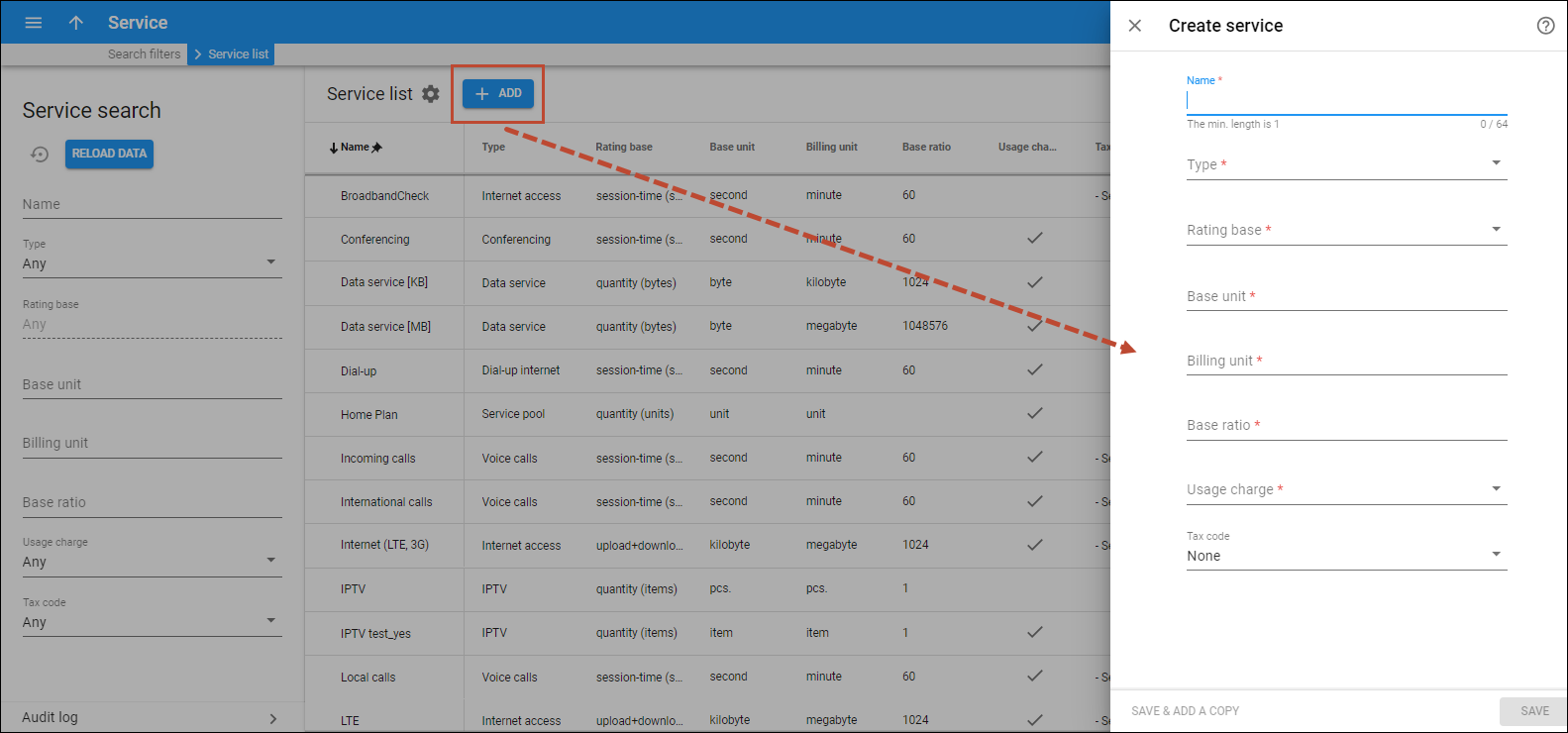

To add a new service, click Add on the Service list panel and fill in the details. To save the service configuration, click Save. To create more destination group sets, click Save & Add a copy.

Service name

The service name shown on the administrator interface.

Service type

Choose a type of your service:

- Conferencing – rating conference calls via a PortaSIP Media Server (or some other conferencing server).

- Data service – rating data transfers by using the amount of data transferred as the billing parameter.

- Dial-up internet – dial-up internet access sessions are rated based on session duration.

- IPTV – IPTV services, like pay-per-view movies, are rated based on the number of views.

- Measured service – rating the amount of an allocated resource (e.g., active calls, cloud PBX phone lines), where charges are based on the number of resource units consumed.

- Messaging service – rating messages (e.g., text, SMS, MMS), where charges are based on the number of messages sent.

- Internet access – internet access sessions (e.g., FTTH, PPPoE), which are rated based on session duration or the amount of transferred data.

- Quantity based – generic quantity-based service type; it can be used to apply charges for any service use that is expressible in numeric form (e.g., the number of pizzas ordered).

- Service pool – the set of services provided within a single usage plan.

- Session based – generic time-based service type; it can be used to apply charges for any service use that is based on the length of time the service was accessed.

- Voice calls – rating telephony calls (incoming or outgoing) that are made via a PortaSIP, VoIP gateways or some other equipment.

- Wi-Fi – wireless Internet access sessions are rated based on session duration.

Rating base

Choose the rating base for your service. This defines a particular parameter used to calculate the charges.

The rating base depends on the type of service you selected above. Each service type supports at least one rating base.

Base unit

Base units are used to measure the amount of the service consumed. This is the smallest element that can be rated. For example, the base unit is a kilobyte. When a customer downloads 758 bytes, it is understood that he downloaded 1 kilobyte. When you select a rating base, the base unit is automatically preset and can’t be changed.

You can change the default base unit name to a new name.

Billing unit

Billing units are used to calculate service charges. This is the unit that defines the pricing for customers. The usage details in xDRs are shown in billing units. For example, the billing units for calls are minutes, and for data transfer services – megabytes. When you select a rating base, the billing unit is automatically preset.

You can change the default billing unit to a new one.

Base ratio

Base ratio defines how many base units make up one billing unit (e.g., 1024 bytes make 1 kilobyte). This parameter affects the calculations in all the xDRs for this service.

To deploy a new service with a different ratio between units (e.g., 1000 bytes make 1 kilobyte), create a new service type before making further configurations.

Usage charge

The usage charge defines whether the service is charged according to a rating plan (tariff).

Select an option:

- Yes – to charge for a service according to a tariff (e.g., voice calls service). The system checks that a rating entry for the service is added to the product. If the rating entry is absent, the product isn’t available for use.

- No – don’t charge for the service according to a tariff (e.g., IPTV services, since users pay for subscriptions). The rating entry is optional for the product. The product is available for use under any circumstances.

Tax code

Choose an internal tax code from the list.

This code is used to extract taxation codes for EZTaxe, Avalara, GST or SureTax taxation plug-ins and send them for tax processing as per a bundle promotion.

None means that a service has no tax code assigned.

To set a new tax code, open the Financial panel.